Kurdish Oil Smuggling: Unraveling The Flourishing Trade To Iran

In the tumultuous landscape of the Middle East, where geopolitics often intertwines with economic survival, a clandestine trade route has quietly blossomed, drawing significant attention: Kurdish oil smuggling to Iran flourishes. This unofficial yet robust pipeline of energy, involving hundreds of oil tankers snaking daily across rugged terrains, represents a complex interplay of regional economics, political maneuvering, and the sheer drive for profit. It's a story of barrels changing hands under the radar, impacting not just local economies but also international agreements and the delicate balance of power in a volatile region.

The scale and audacity of this operation are striking, as revealed by recent investigations. Far from being an isolated incident, the movement of oil and refined fuel between Iraqi Kurdistan and Iran has become a significant, albeit illicit, enterprise. Understanding this trade requires delving into the logistical challenges, the financial incentives, and the broader implications for both the Kurdistan Region of Iraq and the international community. This article will explore the intricate details of this flourishing trade, shedding light on its mechanics, its impact, and why it continues to thrive despite its unofficial status.

Table of Contents

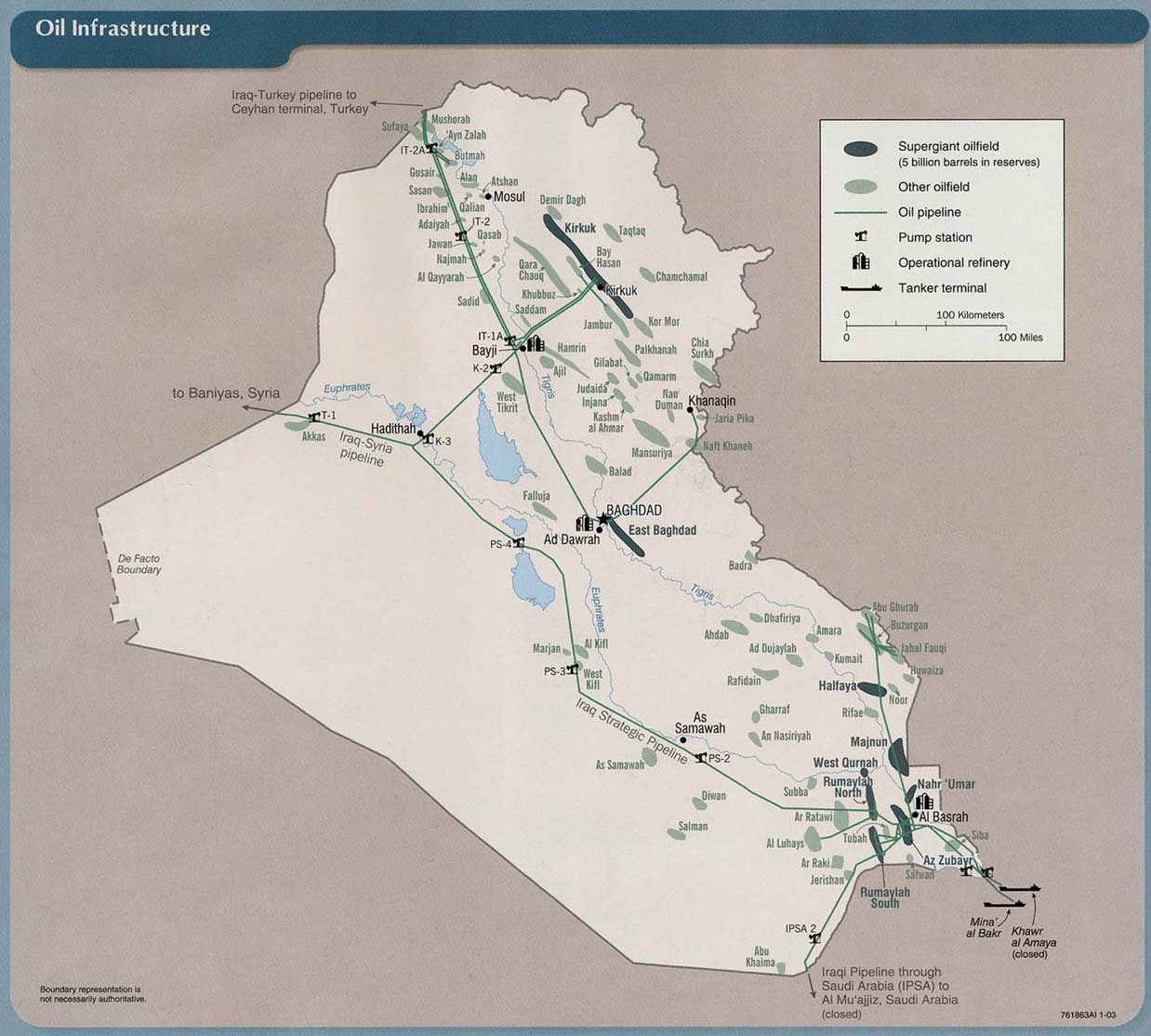

The Visual of the Smuggling Routes

Imagine a winding, mountainous highway, not far from Kurdistan's capital, Erbil. Day in and day out, this artery pulses with the slow, deliberate movement of hundreds of oil tankers. These aren't just any trucks; they are the silent workhorses of a massive, unofficial trade, carrying precious cargo either north towards Turkey or, more significantly, east towards Iran. Pictures taken as recently as May 11, 2024, near the Iraqi border with Turkey, on the outskirts of Duhok province, Iraq, vividly capture this relentless procession. These images serve as a stark visual testament to the sheer volume of traffic involved in what has become known as the flourishing Kurdish oil smuggling to Iran. The highways, often ill-equipped for such heavy and continuous traffic, bear the brunt, becoming clogged with these behemoths of the road. This visual reality underscores the logistical challenges and the persistent nature of this illicit trade, which operates with a remarkable degree of visibility despite its unofficial status.

The Scale of the Clandestine Trade

The term "flourishes" is not an exaggeration when describing the current state of Kurdish oil smuggling to Iran. What might once have been an opportunistic, small-scale venture has evolved into a sophisticated and highly profitable operation. The sheer magnitude of this trade has only recently come into sharper focus, thanks to in-depth investigations that peel back the layers of secrecy surrounding it. This isn't just a few rogue trucks; it's a systemic flow of energy that has significant economic and geopolitical implications. The scale of these unofficial exports has not been widely reported until recently, making the findings even more impactful.

Quantifying the Flow

A Reuters investigation, published around July 11, 2024, brought the true scope of this operation to light, providing concrete figures that underscore its immense scale. The report revealed that more than 1,000 tanker trucks are actively involved in this clandestine movement of oil. These aren't empty vessels; they are transporting a substantial volume of crude oil and refined products. Specifically, the investigation found that these tankers are smuggling at least 200,000 barrels of discounted oil every single day. While a portion of this flow is directed towards Turkey, the predominant destination, and the focus of this particular concern, is Iran. This daily movement of 200,000 barrels represents a significant quantity, enough to influence regional energy markets and provide a substantial revenue stream for those involved. The consistency and volume of this trade highlight its entrenched nature within the region's economic fabric, making Kurdish oil smuggling to Iran a major, albeit unacknowledged, player.

Financial Implications

The economic incentives driving this massive operation are, predictably, substantial. The discounted nature of the oil being smuggled means that while it's sold below market rates, the sheer volume translates into immense profits for the intermediaries and facilitators. The Reuters report estimates that this clandestine trade generates an astonishing sum: around $200 million monthly. To put that into perspective, that's $2.4 billion annually flowing through unofficial channels. This staggering figure illustrates why this trade continues to thrive despite the inherent risks and the unofficial nature of the transactions. For various actors within Iraqi Kurdistan, and potentially beyond, this illicit revenue stream provides a significant source of income, funding operations, and enriching individuals or groups. The financial allure is a primary driver behind the continued flourishing of Kurdish oil smuggling to Iran, making it a powerful economic force in the region's shadow economy.

The Dual Nature of the Trade

What makes this particular trade route even more intriguing is its bidirectional flow, reflecting a complex energy dynamic between Iraqi Kurdistan and Iran. It's not simply a one-way street of oil moving from Kurdistan to Iran. Instead, the situation is more nuanced: Iranian refined fuel is smuggled out to Iraqi Kurdistan, often to meet local demand or for further distribution within Iraq. Conversely, and perhaps more significantly in terms of volume and geopolitical impact, crude oil from Iraqi Kurdistan is smuggled into Iran. This dual nature suggests a symbiotic, albeit illicit, relationship where both parties benefit from the exchange. Iran, facing international sanctions, might find the crude oil from Kurdistan a valuable, albeit unofficial, input for its refineries or for re-export. For Iraqi Kurdistan, the trade offers an outlet for its oil, especially when official export channels are constrained or less profitable, and provides access to refined products. This intricate dance of cross-border energy exchange highlights the adaptability of regional actors in navigating complex political and economic landscapes, further cementing why Kurdish oil smuggling to Iran flourishes.

Geopolitical Ramifications

The unofficial flow of oil, particularly when it reaches the scale observed with Kurdish oil smuggling to Iran, inevitably ripples through the geopolitical landscape. It challenges established norms, impacts international agreements, and adds another layer of complexity to already volatile regional dynamics. The very existence of such a large-scale clandestine trade route underscores the limitations of formal controls and the powerful incentives that drive actors to operate outside conventional frameworks.

Impact on OPEC Commitments

One of the most direct and significant geopolitical impacts of this flourishing trade concerns Iraq's commitments to the OPEC oil cartel. Iraq, as a major oil producer and a member of OPEC, is bound by agreements to limit its oil output to stabilize global prices. However, Iraqi officials have indicated that the scale of these unofficial exports, which had not been previously reported in such detail, is a key reason why Iraq has been unable to stick to the output cuts agreed with OPEC this year. When a substantial volume of oil leaves the country through unofficial channels, it becomes difficult to accurately monitor and control total output, thereby undermining Iraq's ability to adhere to its quotas. This situation creates tension within OPEC and raises questions about the transparency and accountability of oil production figures from the region. The continued Kurdish oil smuggling to Iran, therefore, directly complicates Baghdad's international energy policy and its relationship with other major oil-producing nations.

Regional Dynamics

Beyond OPEC, the illicit oil trade profoundly influences regional dynamics. For Iran, receiving discounted crude oil, even through unofficial channels, can help mitigate the effects of international sanctions, providing a lifeline for its energy sector. This flow of oil potentially undermines the effectiveness of global efforts to restrict Iran's access to international markets. For Iraqi Kurdistan, the trade provides a degree of economic autonomy, though it also exposes the region to risks associated with illicit activities and potential international scrutiny. It highlights the complex relationship between Erbil and Baghdad, where disputes over oil revenues and export rights are long-standing. Furthermore, the involvement of various actors in facilitating this trade could empower certain groups or individuals, potentially shifting local power balances. The very existence of such a robust smuggling network suggests a level of tolerance, or perhaps even complicity, from various authorities or factions, adding layers of complexity to the already intricate political fabric of the region. The persistent nature of Kurdish oil smuggling to Iran thus serves as a barometer of regional tensions and economic pressures.

Challenges and Oversight

Despite its flourishing nature, the Kurdish oil smuggling to Iran operation is not without its challenges and inherent risks. Operating outside official channels means a lack of legal protection, exposure to criminal elements, and vulnerability to shifts in political will. The mountainous and often remote routes, while offering a degree of concealment, also present significant logistical hurdles and dangers for the drivers and their cargo. Accidents, breakdowns, and security threats are constant companions on these arduous journeys. Moreover, the unofficial nature of the trade means there is little to no regulatory oversight regarding environmental standards, safety protocols, or fair labor practices, leading to potential exploitation and ecological damage.

From an international perspective, the lack of oversight is a major concern. The absence of transparent accounting for these oil flows makes it difficult for global bodies to accurately assess energy markets, enforce sanctions, or monitor regional stability. While the Reuters investigation has shed light on the scale, the precise mechanisms of control, the identities of key beneficiaries, and the extent of any official complicity remain largely opaque. This opacity allows the trade to persist, making effective intervention or regulation incredibly challenging. The continuous flow of Kurdish oil smuggling to Iran underscores a significant gap in regional and international governance of energy resources, presenting a persistent challenge to stability and transparency.

Why the Trade Flourishes

The question of why Kurdish oil smuggling to Iran flourishes despite its illicit nature is multifaceted, rooted in a combination of economic necessity, geopolitical pressures, and the unique circumstances of the Kurdistan Region of Iraq. Firstly, economic incentives are paramount. For Iraqi Kurdistan, the ability to sell oil, even at a discount, through alternative channels provides much-needed revenue, especially when official oil exports face disruptions, legal challenges from Baghdad, or limited access to international markets. The allure of quick and substantial profits for individuals and groups involved in the logistics and facilitation of the trade is a powerful motivator. The estimated $200 million monthly revenue stream is a testament to this financial pull.

Secondly, Iran's demand for crude oil, coupled with its international isolation due to sanctions, creates a ready market for discounted oil. This unofficial supply helps Iran meet its domestic energy needs or potentially allows it to free up its own production for sanctioned exports, providing a crucial loophole in the global sanctions regime. Thirdly, the porous and often difficult-to-monitor borders between Iraq and Iran, coupled with the rugged terrain, provide natural cover for clandestine operations. The established networks and infrastructure, built over years of unofficial trade, further facilitate the smooth movement of tankers. Finally, the complex political landscape within Iraq and the Kurdistan Region, characterized by various factions and differing allegiances, can create environments where such unofficial activities are tolerated or even tacitly supported by certain actors who benefit from them. These combined factors create a fertile ground where Kurdish oil smuggling to Iran can not only survive but truly flourish.

Looking Ahead: The Future of Kurdish Oil Smuggling

The future of Kurdish oil smuggling to Iran is intricately linked to the evolving geopolitical landscape, the effectiveness of international sanctions, and the internal dynamics within Iraq and the Kurdistan Region. As long as economic disparities persist, official export channels remain constrained, and Iran faces international sanctions, the powerful incentives for this illicit trade will likely endure. The sheer scale and profitability, as evidenced by the daily flow of 200,000 barrels and $200 million monthly, suggest a deeply entrenched system that will be difficult to dismantle quickly.

However, increased scrutiny, like the Reuters investigation, could lead to greater pressure from international bodies and the Iraqi federal government to curb these activities. Any significant shift in US-Iran relations or the global sanctions regime could also alter the demand side of this equation. Domestically, greater political stability and economic diversification within the Kurdistan Region could reduce the reliance on unofficial oil revenues. Yet, given the historical context and the current economic realities, it is plausible that this clandestine trade will continue in some form, adapting to new challenges and finding new routes. The resilience of such networks in the face of adversity is often remarkable, indicating that Kurdish oil smuggling to Iran may remain a significant, albeit shadowy, feature of the regional energy landscape for the foreseeable future.

Conclusion

The phenomenon of Kurdish oil smuggling to Iran flourishes as a complex and deeply entrenched aspect of the Middle East's energy landscape. From the visual spectacle of hundreds of tankers clogging mountainous highways to the staggering financial figures of $200 million monthly, this clandestine trade is a powerful testament to the interplay of economic necessity, geopolitical pressures, and the ingenuity of unofficial networks. It highlights significant challenges for Iraq's adherence to OPEC agreements, complicates regional stability, and underscores the limitations of international sanctions.

Understanding this trade is crucial for anyone seeking to grasp the intricate dynamics of the region. While its unofficial nature presents immense challenges for oversight and regulation, its impact is undeniably real and far-reaching. As the world continues to grapple with energy security and geopolitical tensions, the story of Kurdish oil smuggling to Iran serves as a potent reminder of the hidden currents that shape global markets and regional power balances. What are your thoughts on the implications of such large-scale unofficial trade? Share your perspectives in the comments below, or explore other articles on our site to delve deeper into the complex world of Middle Eastern energy and politics.

U.S. expands mission to stop Iran’s arms smuggling to Yemen - The

Opinion | Send confiscated stockpiles of Iranian weapons to Ukraine

Inside Islamic State’s oil empire: how captured oilfields fuel Isis