Iran Tariffs: Unpacking Economic Leverage & Geopolitical Tensions

The intricate web of international relations often sees economic tools deployed as instruments of foreign policy, and few examples illustrate this more vividly than the application of tariffs on Iran. These measures, particularly under the Trump administration, have been a recurring theme in the broader strategy of exerting pressure on Tehran, intertwined with critical geopolitical issues like nuclear proliferation and regional stability. Understanding the nuances of these tariffs requires delving into their intended impact, their actual effectiveness, and the complex retaliatory measures they have provoked.

The discussion around tariffs on Iran is not merely an economic one; it's deeply embedded in a larger narrative of diplomatic standoff, sanctions, and the pursuit of strategic objectives. From the threat of military action to the delicate dance of nuclear negotiations, tariffs have served as a persistent, albeit sometimes limited, lever in the hands of global powers. This article will explore the multifaceted dimensions of these economic pressures, examining their historical context, direct and indirect implications, and the broader landscape of trade and sanctions that define the relationship between Iran and the international community.

Here's a detailed overview of the topics we'll cover:

- Historical Context: Trump's Tariff Strategy Against Iran

- Direct Economic Impact: A Limited Tool for Pressure

- The Potent Threat of Secondary Tariffs

- Iran's Retaliatory Measures and Their Fluctuations

- Tariffs in the Shadow of Nuclear Deal Talks

- Sanctions vs. Tariffs: A Complex Web of Economic Pressure

- Volatility in Financial Markets and Broader Trade Wars

- The Broader Trade Policy Landscape Beyond Iran

Historical Context: Trump's Tariff Strategy Against Iran

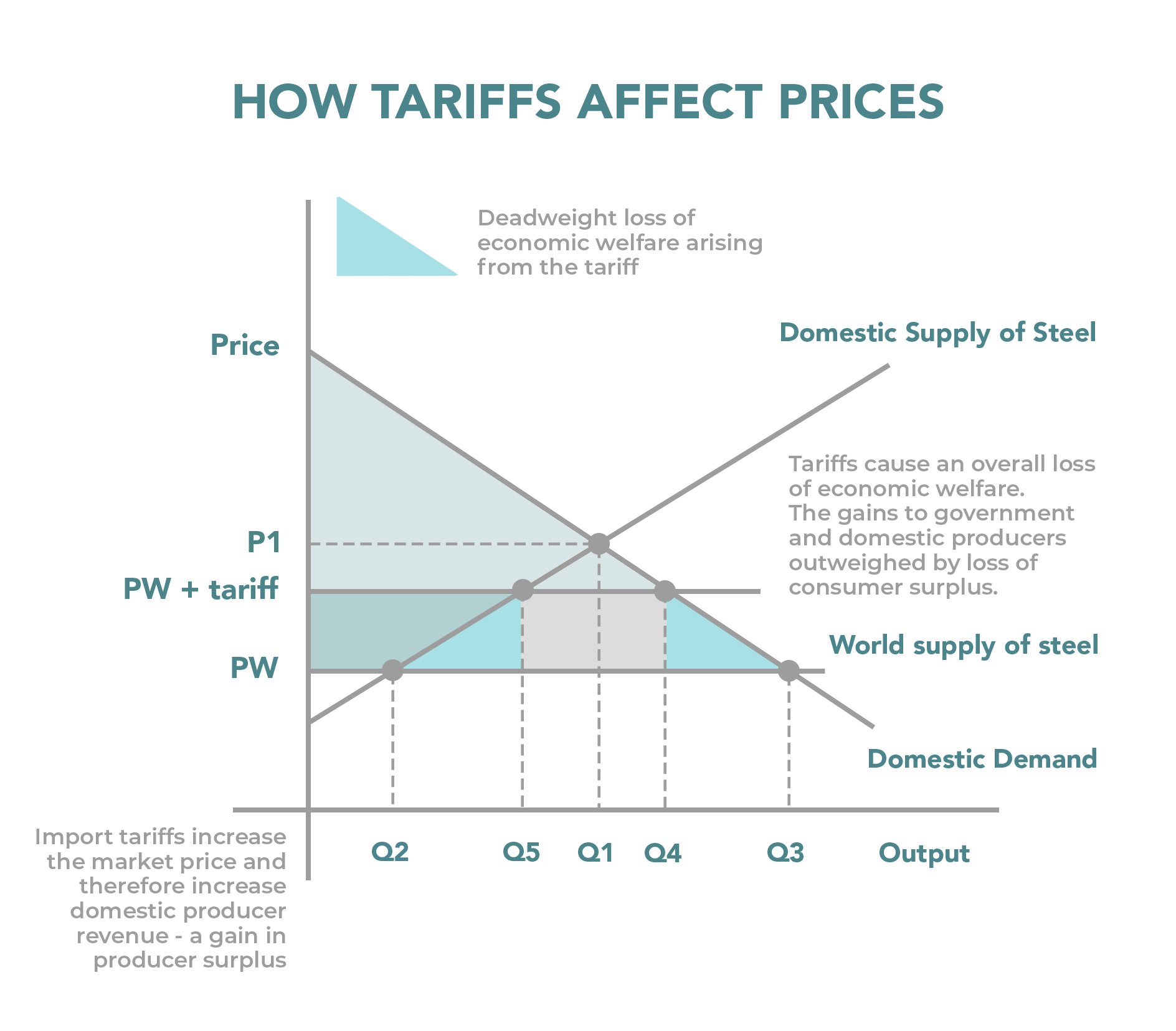

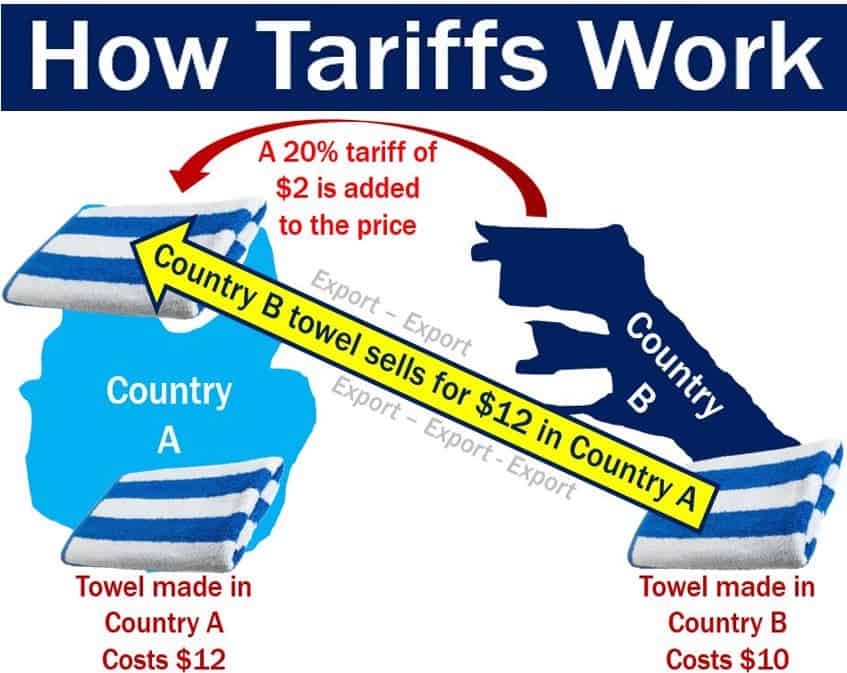

The administration of President Donald Trump marked a significant shift in U.S. foreign policy, characterized by a more aggressive use of economic leverage, including tariffs, against nations perceived as rivals or threats. This approach was particularly evident in the context of Iran. The strategy was not merely about trade imbalances but was deeply intertwined with geopolitical objectives, most notably the desire to renegotiate or dismantle the Iran nuclear deal (Joint Comprehensive Plan of Action - JCPOA). President Trump often linked the imposition of tariffs with other high-stakes decisions, creating a climate of uncertainty and pressure. For instance, President Trump had stated he would decide within two weeks whether or or not the U.S. would strike Iran, a deadline that was very close to the July 9 date he had set to reach a deal with the European Union on tariffs. This illustrates how tariffs were part of a broader, coercive diplomatic toolkit, aimed at compelling Iran to accede to U.S. demands regarding its nuclear program and regional activities. This period saw a deliberate and often public use of economic threats. Trump repeatedly threatened Iran with bombs and tariffs if no new nuclear deal was reached, underscoring the administration's willingness to escalate pressure on multiple fronts. The intent was clear: to exert maximum pressure on the Iranian regime, forcing it to alter its behavior. This strategy, however, often faced skepticism regarding its effectiveness, especially given Iran's long history of enduring sanctions and its limited direct economic ties with the United States. The underlying assumption was that economic pain would translate into political concessions, a hypothesis that proved challenging to validate in the complex U.S.-Iran relationship.Direct Economic Impact: A Limited Tool for Pressure

While the Trump administration frequently utilized tariff increases as a tool to pressure rival nations, this approach had minimal direct economic impact on the Iranian regime. Unlike countries with significant export markets in the U.S., Iran's direct trade with the United States was already severely constrained by decades of existing sanctions. This pre-existing isolation meant that additional tariffs on Iranian goods entering the U.S. market would not significantly alter Iran's economic calculus. The primary economic pressure on Iran stemmed from comprehensive sanctions, particularly those targeting its oil exports and financial system, rather than conventional import tariffs. The limited direct impact of tariffs on Iran is a crucial point often overlooked in broader discussions about trade wars. For a tariff to be an effective leverage tool, the target country must have a substantial economic interest in maintaining access to the imposing country's market. In Iran's case, this interest was negligible due to the existing, extensive sanctions regime. Therefore, while tariffs might have sent a strong political message, their tangible effect on Iran's economy was dwarfed by the broader U.S. sanctions framework. This reality complicated the Trump administration's efforts to use tariffs as a primary economic weapon against Tehran, pushing them to consider other, more impactful measures.Iran's Minimal US Exports

The data clearly illustrates why direct tariffs had little bite. Iran's exports to the United States were exceptionally low, rendering conventional tariffs largely symbolic. In the past year, Iran regime’s exports to the United States amounted to just $6.2 million, a figure projected to drop even further to $2.2 million in 2023. These figures are minuscule in the context of national economies and global trade, indicating that Iran had virtually no direct economic reliance on the U.S. market. This minimal trade volume meant that even a 100% tariff rate on Iranian goods would have had an inconsequential effect on Iran's overall economy. The U.S. market was simply not a significant destination for Iranian products. This stark reality meant that the traditional leverage associated with tariffs – making a country's exports more expensive and thus less competitive – was largely absent when applied directly to Iran. The limited scope of direct trade forced the U.S. to consider other, more indirect, but potentially more damaging, economic pressures.The Potent Threat of Secondary Tariffs

While direct tariffs on Iranian goods had limited impact, the threat of secondary tariffs represented a far more serious and potent economic weapon against Iran. Secondary tariffs, unlike primary tariffs, are not imposed on goods directly entering the U.S. from the target country. Instead, they target third-party countries or entities that engage in trade or financial transactions with the sanctioned nation. This mechanism allows the imposing country to extend its economic reach far beyond its own borders, coercing other nations to comply with its sanctions regime out of fear of facing punitive measures themselves. The prospect of secondary tariffs created a significant dilemma for countries that continued to engage with Iran, particularly in critical sectors like oil. After U.S. President Donald Trump threatened to bomb Iran and impose secondary tariffs, the country allegedly responded by saying that they had “loaded all launchers” in their underground facilities, highlighting the severe tension these threats generated. This type of tariff could effectively cut off Iran from global markets, even if other countries did not officially endorse U.S. sanctions. The fear of being penalized by the U.S. for trading with Iran could compel international businesses and governments to sever ties, thereby isolating Iran economically. This indirect pressure was far more impactful than direct tariffs on a negligible trade volume.Deterring Oil Buyers: A Critical Economic Choke Point

One of the most significant applications of secondary tariffs against Iran was in the oil sector. Oil exports are the lifeblood of Iran's economy, providing the vast majority of its foreign exchange earnings. The threat of secondary tariffs on buyers of Iranian oil was designed to choke off this vital revenue stream. Oil prices rose after Trump threatened secondary tariffs on Russian and Iranian oil buyers, demonstrating the market's sensitivity to such pronouncements. The tariffs could effectively deter countries like China and India, major consumers of oil, from buying Russian and Iranian oil. By threatening to penalize any entity that continued to purchase Iranian crude, the U.S. aimed to dry up demand for Iran's most valuable export. This strategy, combined with existing sanctions on Iran's oil industry, aimed to drastically reduce Iran's ability to fund its government operations and foreign policy initiatives. The effectiveness of secondary tariffs lay in their extraterritorial reach, compelling international actors to choose between access to the U.S. financial system and market, or trade with Iran. This made secondary tariffs a far more formidable instrument of economic warfare than direct tariffs.Iran's Retaliatory Measures and Their Fluctuations

The U.S. imposition of tariffs and withdrawal from the Iran nuclear deal did not go unanswered. In a tit-for-tat response, Iran also imposed tariffs on various U.S. goods. This was a clear signal of Iran's defiance and its willingness to engage in economic countermeasures, even if their practical impact on the U.S. economy was limited. These retaliatory tariffs were part of a broader strategy by Iran to resist U.S. pressure and demonstrate its sovereignty in the face of what it perceived as economic aggression. The specific goods targeted by Iran's tariffs included agricultural products, steel, and aluminum from the U.S. While the volume of these imports from the U.S. was not massive, the tariffs served a political purpose, aiming to inflict some economic pain on U.S. exporters and to rally domestic support against foreign pressure. The tariffs imposed by Iran on U.S. goods have fluctuated in response to changing political and economic circumstances, reflecting Tehran's adaptive approach to the ongoing economic confrontation. This fluctuation highlights the dynamic nature of trade relations under duress, where policies are constantly adjusted in response to external pressures and internal priorities.Targeting US Goods in Response to Sanctions

Iran's decision to impose tariffs on U.S. goods was a direct consequence of the U.S. withdrawal from the Iran nuclear deal in 2018 and the subsequent re-imposition of sanctions. This move by Iran was largely symbolic, given the already low volume of direct trade between the two nations. However, it served to underscore Iran's resolve and its capacity to respond, albeit with limited economic impact, to U.S. economic warfare. The targeting of specific U.S. sectors like agriculture and manufacturing aimed to create domestic political pressure within the U.S. by affecting American businesses and farmers. While these tariffs did not significantly alter the economic landscape for either country, they contributed to the escalating rhetoric and mutual distrust. They were a testament to the fact that economic measures, even when not overwhelmingly impactful, carry significant political weight in international disputes. Iran's actions demonstrated that it would not passively accept U.S. economic pressure but would seek to reciprocate, even if largely for show, in an attempt to project strength and resilience to its domestic audience and the international community.Tariffs in the Shadow of Nuclear Deal Talks

The discussion around tariffs on Iran cannot be separated from the ongoing saga of the Iran nuclear deal. President Trump frequently linked the potential for military action or economic penalties, including tariffs, to the progress (or lack thereof) in nuclear negotiations. Trump explicitly stated he would wait a couple of weeks before deciding on tariffs, often tying such decisions to the broader diplomatic efforts concerning Iran's nuclear program. This strategic delay and public deliberation were intended to maintain pressure and leverage in the negotiating process. The threat of tariffs, particularly secondary ones, served as a powerful incentive for Iran to consider a new nuclear agreement from the U.S. perspective. Meanwhile, talks with Iran on a potential nuclear deal got underway, indicating that despite the economic pressures, diplomatic channels remained open, albeit fraught with tension. The interplay between economic coercion and diplomatic engagement highlights a complex foreign policy approach where tariffs are not just punitive measures but also bargaining chips in high-stakes negotiations. The goal was to use economic pain as a catalyst for political concessions, forcing Iran to the negotiating table under terms more favorable to the U.S. This delicate balance between pressure and diplomacy defined much of the Trump administration's approach to Iran.Sanctions vs. Tariffs: A Complex Web of Economic Pressure

It is crucial to distinguish between tariffs and sanctions, although they often operate in tandem and contribute to a broader economic pressure campaign. Sanctions are typically broader restrictions on trade, finance, and investment, often targeting specific sectors, individuals, or even entire economies, aiming to isolate a country from the global financial system. Tariffs, on the other hand, are taxes on imported goods. While both aim to exert economic pressure, sanctions tend to be far more comprehensive and debilitating than tariffs, especially when a country's direct trade with the imposing nation is minimal. In the case of Iran, the U.S. still imposes extensive sanctions on both Iran and Syria. This means that tariffs, in isolation, won’t make a huge difference for now, as the more stringent sanctions already restrict most legitimate trade. The existing sanctions regime already significantly curtails Iran's access to international markets and financial institutions, making it difficult for Iranian goods to reach the U.S. even without additional tariffs. Therefore, tariffs on Iran often serve more as a political statement or an additional layer of pressure rather than the primary economic constraint. The real economic squeeze on Iran comes from the comprehensive sanctions that target its oil exports, banking sector, and other vital industries, severely limiting its ability to conduct international trade and access foreign currency.Syria's Role and Future Implications

The mention of Syria in the context of U.S. sanctions alongside Iran highlights the interconnectedness of U.S. foreign policy in the Middle East. The U.S. has maintained sanctions on Syria due to its support for terrorism and human rights abuses. The statement that "if, however, sanctions on Syria are lifted, as the new government in Damascus is," introduces a hypothetical scenario that could potentially alter the dynamics of regional trade and, by extension, Iran's economic pathways. Should sanctions on Syria be lifted, it could theoretically open up new avenues for trade and transit for Iran, potentially lessening the impact of some U.S. economic restrictions. Syria has historically been a strategic ally and a conduit for Iranian influence in the Levant. Any change in Syria's international economic status could provide Iran with indirect economic relief or new trade routes, especially for non-oil goods. This scenario underscores how U.S. economic policy towards one country can have ripple effects across an entire region, influencing the effectiveness of measures like tariffs and sanctions on neighboring states. The future of sanctions on Syria remains a critical variable in the broader geopolitical and economic landscape of the Middle East, with potential implications for Iran's economic resilience.Volatility in Financial Markets and Broader Trade Wars

The Trump administration's aggressive use of tariffs extended beyond Iran, significantly impacting global financial markets and initiating broader trade wars, particularly with China. This period was marked by considerable volatility as investors reacted to rapid shifts in trade policy. Financial markets were volatile as Trump paused his steepest tariffs on many countries but deepened his trade war with China. This context is crucial for understanding the environment in which tariffs on Iran were discussed and implemented. The market's sensitivity to tariff announcements meant that even the threat of tariffs could cause significant fluctuations in commodity prices, stock markets, and currency valuations. The broader trade war with China, for example, involved massive tariffs on hundreds of billions of dollars worth of goods, directly impacting global supply chains and economic growth. While the scale of direct trade with Iran was incomparable, the administration's willingness to use tariffs as a primary tool of economic statecraft created an overarching atmosphere of uncertainty. This volatility affected global oil prices, shipping costs, and investment decisions, indirectly influencing Iran's economic outlook even if direct tariffs had limited effect. The perception that the U.S. was willing to disrupt global trade norms for political ends meant that every tariff announcement, regardless of target, contributed to a climate of unpredictability in international commerce.The Broader Trade Policy Landscape Beyond Iran

The Trump administration's approach to tariffs was part of a wider philosophy that sought to redefine global trade relationships. President Donald Trump announced a comprehensive new trade policy on April 2 that revealed a striking disparity in tariff rates between Israel and other nations. This highlights a selective and often politically motivated application of tariffs, where allies might receive preferential treatment while adversaries face heightened barriers. This selective application underscores that tariffs were not solely about rectifying trade imbalances but were deeply integrated into geopolitical alliances and rivalries. The administration's stance on tariffs was often characterized by a transactional approach to international relations, where economic leverage was used to achieve political ends. Trump refused to commit to reducing fresh tariffs on Israeli goods, indicating a willingness to use tariffs even against close allies if it served perceived national interests or leverage points. This broader context of aggressive tariff policy, from China to Europe and specific instances like Israel, demonstrates that the tariffs on Iran were not an isolated phenomenon but part of a consistent, albeit controversial, economic statecraft strategy. To view tariff measures and preferential beneficiaries, one would typically use support materials menus after login to specific trade databases, indicating the complexity and detailed nature of global tariff structures. This rate includes preferential tariff when it exists, further complicating the analysis of trade barriers. This broader landscape shows that the U.S. was actively re-evaluating and re-shaping its trade relationships globally, with tariffs serving as a central instrument in this transformation.Conclusion

The application of tariffs on Iran, particularly during the Trump administration, serves as a compelling case study in the use of economic tools for geopolitical leverage. While direct tariffs on Iranian goods had a minimal economic impact due to pre-existing sanctions and negligible direct trade, the threat of secondary tariffs proved to be a far more potent weapon, capable of isolating Iran from global oil markets and financial systems. Iran's retaliatory tariffs, though largely symbolic, underscored the tit-for-tat nature of this economic confrontation. The narrative of tariffs on Iran is inextricably linked to the broader diplomatic efforts surrounding the nuclear deal and the complex web of U.S. sanctions. It highlights how economic pressure is often deployed in concert with diplomatic threats, creating a volatile environment for international relations and financial markets. As the global landscape continues to evolve, understanding the nuanced role of tariffs, distinct from but often intertwined with comprehensive sanctions, remains crucial for comprehending the dynamics of international power projection. We hope this deep dive into the complexities of tariffs on Iran has provided valuable insights. What are your thoughts on the effectiveness of economic sanctions and tariffs in achieving foreign policy objectives? Share your perspectives in the comments below, or explore our other articles on international trade and geopolitics for more in-depth analysis.- Number Of Jews In Iran

- Us Dollar To Iran

- Majlis Iran

- Iran Medals In Olympics 2024

- Us Sanctions On Iran

Chart: In a year, U.S. Tariffs Surge Far Past Advanced Economies | Statista

Tariff | Definitions & Examples | InvestingAnswers

What are tariffs? Definition and meaning - Market Business News