Treasury Iran Sanctions: Unpacking Washington's Economic Pressure

The intricate web of **Treasury Iran sanctions** represents a cornerstone of U.S. foreign policy, designed to exert significant economic pressure on the Islamic Republic. These measures, primarily orchestrated by the Department of the Treasury's Office of Foreign Assets Control (OFAC), aim to curb Iran's nuclear ambitions, ballistic missile development, support for terrorism, and human rights abuses. Understanding the scope and evolution of these sanctions is crucial for businesses, financial institutions, and anyone navigating the complexities of international trade and geopolitics.

From comprehensive asset blocking to targeted restrictions on key economic sectors, the U.S. government employs a multi-faceted approach. This article delves into the mechanisms, targets, and far-reaching implications of the Treasury Iran sanctions, providing a detailed overview of Washington's strategy to isolate and compel changes in Tehran's behavior.

Table of Contents

- Understanding the US Treasury's Iran Sanctions

- The Evolution of Sanctions: From Trump's "Maximum Pressure" to Current Actions

- Targeting Iran's Economic Lifelines: Oil, Petrochemicals, and LPG

- Unmasking the "Shadow Banking" Network

- Key Executive Orders Driving Treasury Iran Sanctions

- Recent Actions and the Broader Geopolitical Context

- Navigating Compliance: Guidance from OFAC

- The Far-Reaching Implications of Treasury Iran Sanctions

Understanding the US Treasury's Iran Sanctions

At the heart of the U.S. government's economic pressure campaign against Iran lies the Department of the Treasury's Office of Foreign Assets Control (OFAC). This powerful agency is tasked with administering and enforcing economic and trade sanctions based on U.S. foreign policy and national security goals. OFAC's reach is extensive, affecting not only U.S. persons but also, in many cases, foreign entities and individuals who engage in transactions with sanctioned parties or sectors. As the primary implementer of these financial restrictions, OFAC offers comprehensive guidance on a variety of subjects related to the Iran sanctions program, making it an indispensable resource for anyone operating in this complex landscape.

The sanctions themselves can be either comprehensive or selective. Comprehensive sanctions typically involve a broad prohibition on all transactions and dealings with a targeted country, while selective sanctions target specific individuals, entities, sectors, or activities within that country. For Iran, the approach has been a blend of both, evolving over time to become increasingly targeted at the regime's revenue streams and illicit networks. The tools OFAC employs include the blocking of assets, which freezes any property or interests in property of designated individuals or entities within U.S. jurisdiction, and various trade restrictions that prohibit specific types of transactions or exports. The objective is clear: to disrupt Iran's ability to finance activities deemed destabilizing by the United States, thereby accomplishing critical foreign policy and national security goals.

The Evolution of Sanctions: From Trump's "Maximum Pressure" to Current Actions

The trajectory of **Treasury Iran sanctions** has seen significant shifts, particularly under the Trump administration's "maximum pressure" campaign. This aggressive strategy aimed to drive Iran's export of oil to zero, significantly curtailing the regime's primary source of revenue. The restoration of sanctions following the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA) marked a pivotal moment, ushering in a new era of intensified economic warfare. This was not merely a re-imposition of old measures; it involved the introduction of new, more stringent restrictions.

For instance, the data indicates that this was the second round of sanctions imposed on Iranian oil sales since President Donald Trump issued National Security Presidential Memorandum 2, which explicitly called for the U.S. to eliminate Iran's oil exports. Furthermore, the Treasury Department confirmed that it was the second round of sanctions specifically targeting Iranian weapons proliferators since the maximum pressure campaign was restored. These actions were taken pursuant to specific executive orders, such as E.O. 13846, which authorizes and reimposes certain sanctions, and E.O. 13902, which specifically targets Iran's petroleum and petrochemical sectors. The systematic application of these executive orders formed the backbone of a campaign designed to squeeze Iran's economy from multiple angles, impacting its ability to fund its various strategic programs and proxies.

Targeting Iran's Economic Lifelines: Oil, Petrochemicals, and LPG

A central pillar of the **Treasury Iran sanctions** strategy is the relentless targeting of Iran's vital economic sectors, particularly its energy industry. The petroleum and petrochemical sectors are identified as critical revenue generators for the Iranian regime, funding its nuclear program, the development and proliferation of provocative ballistic missiles, and its financing of regional proxies. Executive Order (E.O.) 13902, for example, explicitly targets these sectors, signaling a clear intent to deprive Tehran of its financial lifeblood. On October 11, 2024, the Secretary of the Treasury formally identified these sectors of the Iranian economy as subject to sanctions, underscoring their strategic importance to the regime.

The impact of these sanctions is tangible. The U.S. has imposed sanctions on numerous entities and vessels playing a critical role in transporting illicit Iranian petroleum to foreign markets. These sanctioned ships are known to move crude oil valued in the hundreds of millions of dollars, according to the Treasury, illustrating the scale of the illicit trade the sanctions aim to disrupt. Beyond crude oil, the U.S. Treasury has also targeted the liquefied petroleum gas (LPG) sector. For instance, OFAC designated Iranian national Seyed Asadoollah Emamjomeh and his corporate network, collectively responsible for shipping hundreds of millions of dollars' worth of Iranian LPG and crude oil to foreign markets. These actions impose additional costs on Iran's petroleum sector, often in response to specific escalations such as Iran's attack against Israel on October 1, 2024, and its announced nuclear escalations, building upon existing sanctions.

The Role of Shipping and Maritime in Sanctions Evasion

The maritime industry plays a crucial, albeit often illicit, role in Iran's efforts to evade **Treasury Iran sanctions**. Given the global nature of shipping, it presents a complex challenge for enforcement. OFAC has recognized this by issuing advisories specifically for shipping and maritime stakeholders on detecting and mitigating Iranian oil sanctions evasion. These advisories highlight the sophisticated methods employed by Iran to obscure the origin of its oil and the identity of its vessels, including ship-to-ship transfers, disabling Automatic Identification Systems (AIS), and using false documentation.

The sanctions frequently target shipping companies and oil brokers involved in these illicit activities. For example, among those sanctioned have been oil brokers operating in the United Arab Emirates (UAE) and Hong Kong, indicating the international reach of Iran's evasion networks. Specific entities, such as Unico Shipping Co Ltd and Athena Shipping Co Ltd, both based in Hong Kong, have been explicitly designated by OFAC for their involvement in facilitating the movement of Iranian petroleum. These designations underscore the U.S. government's commitment to disrupting the entire supply chain of illicit Iranian oil, from extraction to delivery to foreign markets.

Unmasking the "Shadow Banking" Network

Beyond the energy sector, a significant focus of **Treasury Iran sanctions** has been the dismantling of Iran's "shadow banking" networks. These clandestine financial systems are crucial for the Iranian regime, particularly its Ministry of Defense and Armed Forces Logistics (MODAFL) and the Islamic Revolutionary Guard Corps (IRGC), to gain illicit access to the international financial system. These networks enable sanctioned entities to bypass traditional banking channels, facilitating the movement of funds for prohibited activities without detection.

In a significant move, the Department of the Treasury’s OFAC sanctioned nearly 50 entities and individuals constituting multiple branches of such a sprawling network. This action marked the first round of sanctions specifically targeting Iranian shadow banking infrastructure since the president issued National Security Presidential Memorandum 2, directing a comprehensive campaign of pressure. MODAFL itself has been designated pursuant to relevant executive orders, further tightening the financial noose around Iran's military and security apparatus. The exposure and disruption of these networks are critical to preventing Iran from circumventing sanctions and accessing funds necessary for its destabilizing agenda.

Impact on Illicit Financing and Proliferation

The unmasking and targeting of Iran's shadow banking infrastructure directly impacts the regime's ability to engage in illicit financing and proliferation activities. The revenue generated through these covert channels, often from the sale of petroleum and petrochemicals, is funneled directly to support Iran’s nuclear program, its development and proliferation of provocative ballistic missiles, and the financing of its various proxy groups across the Middle East. By disrupting these financial pipelines, the **Treasury Iran sanctions** aim to starve these programs of funding.

The sanctions aim to make it exceedingly difficult and costly for Iran to acquire the necessary components, technology, and expertise for its weapons programs. When OFAC designates entities involved in these networks, it effectively cuts off their access to the legitimate international financial system, making it harder to process payments, obtain letters of credit, and conduct other necessary financial transactions. This financial pressure is a direct attempt to degrade Iran's capabilities and force it to reconsider its strategic priorities, ultimately contributing to global security by limiting the spread of dangerous weapons and destabilizing influence.

Key Executive Orders Driving Treasury Iran Sanctions

The legal framework for **Treasury Iran sanctions** is primarily established through a series of Executive Orders (E.O.s) issued by the President of the United States. These orders grant the Treasury Department and OFAC the authority to implement and enforce specific restrictions, targeting various aspects of Iran's economy and behavior. Understanding these foundational E.O.s is essential to grasp the legal basis and scope of the sanctions regime.

Executive Order 13846: Re-imposing and Authorizing Sanctions

Executive Order 13846 is a critical piece of legislation in the current Iran sanctions architecture. This order authorizes and reimposes certain sanctions with respect to Iran, effectively restoring many of the restrictions that were lifted under the JCPOA. The Department of State, in coordination with the Treasury, takes actions pursuant to this E.O., targeting individuals and entities involved in activities that contribute to Iran's proliferation of weapons of mass destruction, its support for terrorism, or its human rights abuses. It serves as a broad authority to maintain significant pressure on Iran across multiple domains.

Executive Order 13902: Targeting Critical Sectors

E.O. 13902 represents a more focused approach, specifically targeting Iran's financial, petroleum, and petrochemical sectors. This executive order grants the Department of the Treasury the authority to impose sanctions on individuals and entities operating in or transacting with these critical industries. The goal is to choke off the primary sources of revenue that the Iranian regime uses to fund its illicit activities. Actions taken pursuant to E.O. 13902 have led to the designation of numerous shipping companies, oil brokers, and financial facilitators involved in Iran's energy trade, directly impacting the country's ability to export its most valuable commodities.

Executive Order 13608: Limiting Risk to US Systems

Executive Order 13608 provides a crucial means through which the Treasury can limit the risk to U.S. commercial and financial systems. This E.O. allows for sanctions against foreign persons determined to have violated U.S. sanctions on Iran or Syria, or to have engaged in deceptive transactions for or on behalf of persons subject to U.S. sanctions on Iran or Syria. This extraterritorial reach is designed to deter third parties from facilitating illicit transactions with sanctioned Iranian entities, thereby protecting the integrity of the U.S. financial system and preventing it from being used as a conduit for illicit funds.

Recent Actions and the Broader Geopolitical Context

The application of **Treasury Iran sanctions** is not static; it is a dynamic process that responds to ongoing geopolitical developments and Iran's actions. Washington frequently imposes new sanctions, often timed with significant events or in response to specific provocations. For example, the United States imposed new sanctions on Iran on a Wednesday, just days before the Islamic Republic's scheduled talks with Washington in Oman. Such timing underscores the U.S. strategy of using economic pressure as leverage in diplomatic engagements.

More recently, actions have been taken to impose additional costs on Iran's petroleum sector following events such as Iran's attack against Israel on October 1, 2024, and Iran's announced nuclear escalations. These measures build upon existing sanctions, demonstrating a continuous escalation of pressure in response to perceived threats. The Treasury Department has designated numerous entities and individuals over time, including those involved in the trade of Iranian petroleum and petrochemicals that generate billions of dollars for the regime. The sheer volume of designations is staggering; the Department of the Treasury’s OFAC has sanctioned more than 700 individuals, entities, aircraft, and vessels under various Iran-related programs, including those added to OFAC's Specially Designated Nationals (SDN) List. Locations like Pob Dehdasht, Kohgiluyeh County, Iran, are often cited in connection with sanctioned entities, highlighting the specific geographical targets of these measures.

Navigating Compliance: Guidance from OFAC

For businesses, financial institutions, and individuals operating globally, navigating the complexities of **Treasury Iran sanctions** is paramount. Non-compliance can lead to severe penalties, including hefty fines, reputational damage, and even criminal charges. Given the intricate nature of these regulations, OFAC offers extensive guidance on a variety of subjects related to the Iran sanctions. This guidance is crucial for understanding who is sanctioned, what activities are prohibited, and how to implement effective compliance programs.

OFAC's resources include detailed FAQs, advisories, and enforcement actions that serve as case studies for what constitutes a violation. They emphasize the importance of robust due diligence, screening against the Specially Designated Nationals (SDN) List and other relevant lists, and understanding the concept of "50 percent rule" for ownership. Businesses are encouraged to establish comprehensive compliance programs that include risk assessments, internal controls, training, and regular audits. Proactive engagement with OFAC's guidance is not just a best practice; it's a necessity to avoid inadvertently facilitating illicit transactions and incurring significant legal and financial repercussions.

The Far-Reaching Implications of Treasury Iran Sanctions

The **Treasury Iran sanctions** have profound and far-reaching implications, extending beyond the immediate targets in Iran. Domestically, they represent a powerful tool of U.S. foreign policy, demonstrating Washington's resolve to counter perceived threats without resorting to military action. Internationally, they create a complex environment for global commerce, forcing companies to choose between accessing the U.S. financial system and doing business with Iran. This often leads to a chilling effect, where many international companies, fearing secondary sanctions, opt to sever ties with Iran altogether, even in sectors not directly targeted by U.S. restrictions.

For Iran, the impact has been severe, contributing to economic contraction, currency depreciation, and inflation. While the regime has developed sophisticated evasion tactics, the continuous pressure on its oil exports, financial networks, and key industries significantly constrains its ability to fund its strategic objectives. The sanctions also create humanitarian challenges, although the U.S. typically includes exemptions for humanitarian trade, the complexities of financial transactions often impede the delivery of essential goods. Ultimately, the Treasury Iran sanctions are a testament to the power of economic statecraft, constantly evolving in response to geopolitical dynamics and aiming to shape Iran's behavior through sustained financial isolation.

Understanding the intricate details of these sanctions is not just an academic exercise; it's a practical necessity for global actors. As the U.S. continues to leverage its economic power, staying informed about OFAC's actions and guidance remains critical for navigating the challenging landscape of international relations and trade. We encourage you to delve deeper into OFAC's official publications and advisories to ensure full compliance and understanding of these vital regulations. What are your thoughts on the effectiveness of these sanctions? Share your insights in the comments below.

Trump Imposes New Sanctions on Iran, Adding to Tensions - The New York

Trying to Hammer Iran With U.N. Sanctions, U.S. Issues More of Its Own

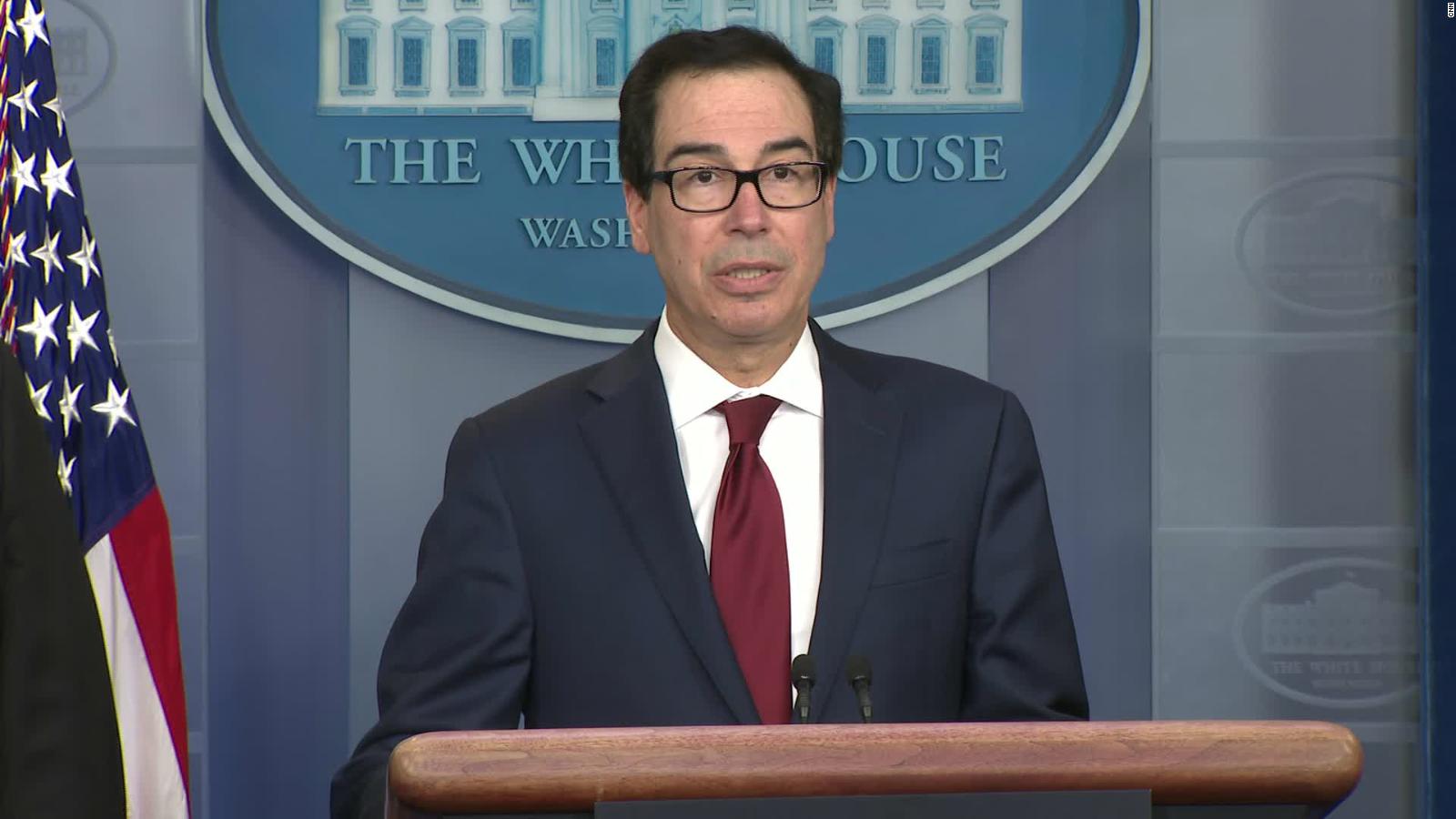

Sanctions: US imposes new penalties on Iran after attacks - CNNPolitics