US-Iran Trade: Unpacking A Complex Economic Relationship

The intricate web of global economics often features relationships defined by more than just supply and demand. Few exemplify this complexity as profoundly as US-Iran trade. Far from a straightforward exchange of goods and services, the economic ties between the United States and Iran are deeply intertwined with decades of geopolitical tensions, diplomatic breakthroughs, and stringent sanctions. This article delves into the nuances of this unique bilateral trade, exploring its historical trajectory, the impact of significant political events, and the current state of commercial exchange, offering a comprehensive look at a relationship that remains largely restricted.

Understanding the dynamics of US-Iran trade requires navigating a landscape dominated by legal restrictions and political declarations. Since 1979, and particularly following a comprehensive embargo in 1995, the United States has maintained significant limitations on commercial activities with Iran. Despite brief periods of potential rapprochement, such as the 2015 nuclear deal, these restrictions largely define the economic interaction, making any trade between the two nations minimal and highly scrutinized. This deep dive aims to illuminate the factual data and the underlying reasons behind the limited, yet perpetually significant, trade relationship.

Table of Contents

- US-Iran Trade: A History of Sanctions and Embargoes

- The Joint Comprehensive Plan of Action (JCPOA): A Brief Thaw

- Current State of US-Iran Trade: Data and Figures

- The Insignificance of Bilateral Trade in the Global Context

- Enforcing the Restrictions: The Role of US Agencies

- Geopolitical Tensions and Their Economic Shadow

- Challenges and the Future of US-Iran Trade

- Conclusion: A Relationship Defined by Caution

US-Iran Trade: A History of Sanctions and Embargoes

The foundation of the current US-Iran trade relationship is built upon a long history of sanctions and political estrangement. Following the seizure of the U.S. Embassy in Tehran in 1979, the United States began imposing restrictions on activities with Iran under various legal authorities. These initial measures marked the beginning of a sustained policy of economic pressure, aimed at influencing Iran's political and nuclear ambitions. A pivotal moment arrived in 1995, when the United States implemented a comprehensive embargo on trade with Iran. This embargo significantly curtailed most forms of direct commercial exchange, making it one of the most restrictive bilateral trade policies in the world. The intention behind these stringent measures has consistently been to isolate Iran economically and to pressure its government on issues ranging from its nuclear program to its regional activities and human rights record. Understanding this historical context is crucial for comprehending why trade in goods with Iran remains so limited today. The legal frameworks established decades ago continue to shape virtually every aspect of economic interaction.The Joint Comprehensive Plan of Action (JCPOA): A Brief Thaw

Amidst decades of tension, a significant diplomatic effort emerged in 2015: the Joint Comprehensive Plan of Action (JCPOA), commonly known as the nuclear deal. The United States played a leading role in these successful negotiations, which aimed to place substantial limits on Iran's nuclear program. Key components of the agreement included IAEA inspections and limitations on enrichment levels, designed to ensure Iran's nuclear activities remained peaceful. The JCPOA offered a glimmer of hope for a potential easing of some sanctions, which could have, in turn, led to a modest increase in US-Iran trade. However, this period of potential rapprochement was short-lived. The subsequent withdrawal of the United States from the agreement and the re-imposition of sanctions under a "maximum pressure" campaign effectively nullified any significant economic benefits Iran might have gained and further tightened the already severe restrictions on bilateral trade. This episode underscores the fragility of economic engagement when deeply tied to complex geopolitical issues.Current State of US-Iran Trade: Data and Figures

Despite the pervasive embargo, a minimal level of trade in goods with Iran still occurs, primarily involving humanitarian goods or specific exempted categories. All figures discussed here are in millions of U.S. Dollars on a nominal basis, not seasonally adjusted, unless otherwise specified. Details may not equal totals due to rounding, and tables reflect only those months for which there was trade. The data available paints a clear picture of a highly restricted and limited economic relationship.US Imports from Iran

According to the United Nations Comtrade Database on international trade, United States imports from Iran were US$6.29 million during 2024. This figure represents a significant decrease compared to previous years, reflecting the ongoing impact of sanctions and political tensions. Looking back, the United States imported $22.3 million in goods from Iran in 2023, as reported by the State Department. This suggests a volatile and often declining trend in the already minuscule import volume. The types of goods imported are typically non-sanctioned items, often related to cultural heritage or specific agricultural products that fall under humanitarian exemptions. However, the overall volume indicates that Iran's access to the U.S. market remains extremely limited.US Exports to Iran

On the export side, the figures show a slightly different, though still constrained, picture. United States exports to Iran were US$90.85 million during 2024, according to the United Nations Comtrade Database on international trade. This is a notable figure when compared to imports, suggesting a potential flow of humanitarian or otherwise permissible goods from the U.S. to Iran. In 2023, the State Department reported that the U.S. exported $59 million in goods to Iran. This resulted in a total trade value of $81.3 million between the countries in 2023. The trade in the first four months of 2024 followed a steady rise in trade exchanged between the two sides in the previous year, which saw eight percent growth and reached $61.2 million. This indicates some level of consistent, albeit small, commercial activity. However, it's crucial to note that Iran exports to the United States were US$112.71 thousand during 2022, according to the United Nations Comtrade Database. This extremely low import figure from Iran into the U.S. in 2022 further underscores the severe imbalance and restrictive nature of the trade relationship.The Insignificance of Bilateral Trade in the Global Context

While the specific figures for US-Iran trade might seem substantial in isolation, it is imperative to contextualize them within the broader scope of global commerce. The amount of trade between Iran and the U.S. is not significant compared to the total trade of the two countries with the rest of the world. For both the United States, a global economic powerhouse, and Iran, a significant regional player, their respective trade volumes with each other represent a mere fraction – often less than one percent – of their total international trade. This insignificance highlights the effectiveness of the long-standing U.S. embargo and sanctions regime. It demonstrates that the primary objective of these policies – to economically isolate Iran from the U.S. market and financial system – has largely been achieved. The minimal trade that does occur is highly scrutinized, often limited to specific humanitarian goods, agricultural products, or items not covered by the extensive list of sanctions. This stark reality underscores that economic considerations are secondary to geopolitical and security concerns in shaping the US-Iran trade relationship.Enforcing the Restrictions: The Role of US Agencies

The enforcement and implementation of the numerous U.S. sanctions programs that restrict access to the United States for Iranian entities and individuals are complex and multi-faceted. The Department of State’s Office of Economic Sanctions Policy and Implementation plays a critical role in this regard. This office is responsible for developing and enforcing policies that align with U.S. foreign policy objectives, often targeting sectors of the Iranian economy deemed critical to its nuclear program, missile development, or support for terrorism. Concurrently, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) is a primary enforcer of these sanctions. OFAC administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other threats to the national security, foreign policy or economy of the United States. Their actions often involve designating entities and individuals, blocking assets, and imposing penalties for violations. For instance, the Department of State recently designated 16 entities and vessels for their involvement in Iran’s petroleum and petrochemical industry, while the Department of State and OFAC concurrently sanctioned a combined total of 22 persons and identified 13 vessels as blocked property across multiple sectors. These actions are a clear demonstration of the U.S. commitment to maintaining pressure on Iran, directly impacting any potential for meaningful US-Iran trade.Geopolitical Tensions and Their Economic Shadow

The economic relationship, or lack thereof, between the U.S. and Iran is inseparable from the broader geopolitical tensions that define their interactions. These tensions often manifest in military posturing, proxy conflicts, and rhetorical exchanges, all of which cast a long shadow over any prospects for normalized US-Iran trade.The Trump Administration and "Maximum Pressure"

Under President Donald Trump, the U.S. adopted a "maximum pressure" campaign against Iran, which involved withdrawing from the JCPOA and imposing even more stringent sanctions. This period was marked by heightened rhetoric and military escalations. For example, President Donald Trump gathered his top security advisers and the U.S. military increased firepower in the Middle East amidst continued trading of strikes between Israel and Iran. Such escalations create an environment of extreme uncertainty and risk for any commercial entity considering engagement, effectively stifling any legitimate trade in goods with Iran. President Trump's statements, such as allowing two weeks for diplomacy before deciding on a strike, further highlighted the volatile nature of the relationship, where military action was always a possibility. In response, Ayatollah Ali Khamenei, Iran’s Supreme Leader, publicly stated that Iran was not frightened by threats from President Donald Trump, signaling a continued standoff.Continued Designations and Enforcement

The policy of designating entities and individuals involved in Iran's strategic sectors continues to be a key tool in the U.S. pressure campaign. These designations are not merely symbolic; they have tangible economic consequences, effectively cutting off targeted entities from the international financial system and making any dealings with them highly risky for global businesses. The recent designation of 16 entities and vessels for their involvement in Iran’s petroleum and petrochemical industry, alongside the sanctioning of 22 persons and identification of 13 vessels as blocked property, exemplifies this ongoing strategy. Such actions reinforce the message that engaging in significant US-Iran trade is not only legally perilous but also politically undesirable for most international actors. These measures directly impact Iran's ability to export its primary revenue generators, further limiting its foreign exchange earnings and its capacity to import goods.Challenges and the Future of US-Iran Trade

The challenges facing any expansion of US-Iran trade are multifaceted and deeply entrenched. The primary hurdle remains the extensive U.S. sanctions regime, which shows no signs of significant relaxation without a major shift in geopolitical dynamics or a renewed, comprehensive agreement on Iran's nuclear program and regional activities. Even if certain sanctions were lifted, the fear of "snapback" sanctions or secondary sanctions on third-country entities doing business with Iran would likely deter most major corporations. Furthermore, the lack of a stable political relationship and the ongoing regional conflicts create an environment of high risk for investors and traders. The unpredictable nature of the relationship, characterized by tit-for-tat actions and strong rhetoric, makes long-term economic planning virtually impossible. For businesses, the compliance costs and reputational risks associated with engaging in trade in goods with Iran are simply too high to justify the minimal potential returns. Looking ahead, any significant change in US-Iran trade would likely necessitate a fundamental shift in diplomatic relations. This could involve a new nuclear deal, de-escalation of regional tensions, or a re-evaluation of U.S. foreign policy objectives concerning Iran. Until such a paradigm shift occurs, the bilateral trade figures are expected to remain at their current, negligible levels, primarily confined to humanitarian exceptions and highly scrutinized transactions. The "tariff simulator report pro!" mentioned in the data, while a useful tool for general trade analysis, highlights the complexity of navigating such a heavily sanctioned environment. It underscores the fact that finding the latest trade data and tariffs between Iran and the United States is less about seeking opportunities and more about understanding the layers of restrictions.Conclusion: A Relationship Defined by Caution

In summary, the story of US-Iran trade is predominantly one of restriction, driven by decades of geopolitical friction and a comprehensive sanctions regime. From the 1995 embargo to the "maximum pressure" campaign, U.S. policy has consistently aimed to limit economic engagement with Iran. The data unequivocally shows that trade volumes are minimal, representing an insignificant portion of either country's global commerce. Despite fleeting moments of potential openness, such as the JCPOA, the overarching narrative remains one of economic isolation enforced through stringent measures by agencies like the State Department and OFAC. The future of trade in goods with Iran hinges not on market forces, but on profound diplomatic breakthroughs and a significant de-escalation of tensions. Until then, the relationship will continue to be defined by caution, compliance, and the stark reality of a near-total economic disconnect. We encourage you to share your thoughts on the complexities of this relationship in the comments below, or explore other articles on our site for more insights into global economic and geopolitical dynamics.- Nuclear Weapons In Iran

- Iranpresident

- Bomb Iran Lyrics

- Religious Leader Of Iran

- Embassy Of Iran Washington Dc

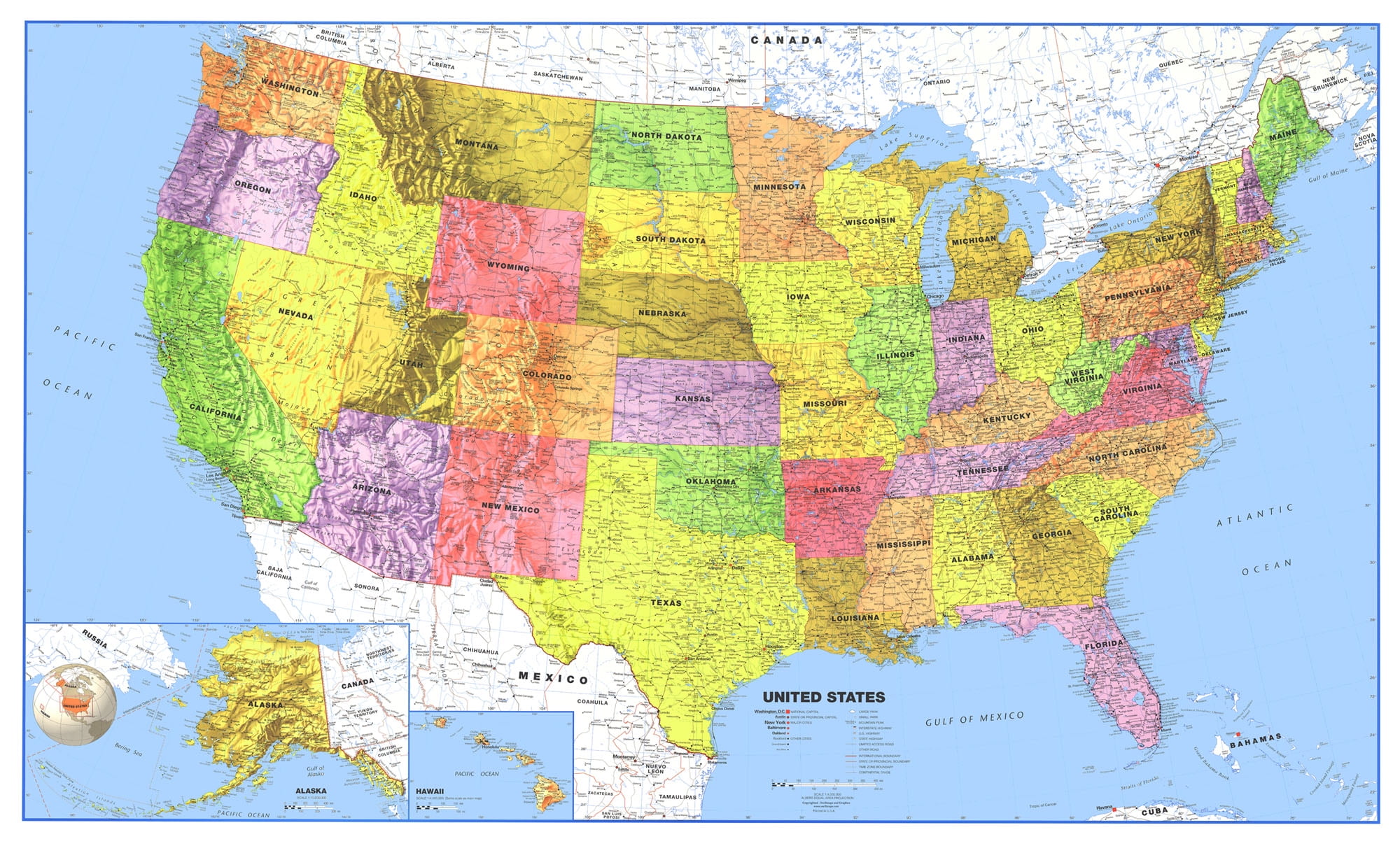

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo