Unpacking US-Iran Money Deals: A Complex Web Of Diplomacy And Funds

Historical Context: A Complex Tapestry of US-Iran Financial Relations

The financial relationship between the United States and Iran is deeply rooted in the aftermath of the 1979 Islamic Revolution. Following the revolution and the subsequent hostage crisis at the US Embassy in Tehran, the United States froze billions of dollars in Iranian assets held in American banks and abroad. These frozen funds became a persistent point of contention and a tool in diplomatic negotiations for decades. Many of the financial settlements reached over the years have been directly or indirectly connected with disputes originating from this period, often intertwined with the release of American citizens held hostage in Iran or Lebanon. These historical precedents set the stage for later agreements, demonstrating a pattern where financial leverage is often employed in tandem with humanitarian or diplomatic objectives. It's crucial to understand that these are rarely, if ever, direct payments or "aid" from the US treasury. Instead, they typically involve the unfreezing of Iranian assets that were held, often for decades, due to sanctions or legal disputes. The narrative of "US releases money to Iran" is therefore more nuanced than it often appears in headlines.The 2016 Prisoner Swap and the $400 Million Payment

One notable instance that drew significant attention was the delivery of an initial $400 million in euros, Swiss francs, and other foreign currency on pallets on January 17, 2016. This payment occurred on the very same day Tehran agreed to release four American prisoners. While critics quickly labeled it a "ransom," the Obama administration maintained that this was the first installment of a $1.7 billion settlement of a long-standing financial dispute between the two countries. This dispute dated back to 1979, concerning a trust fund Iran used to buy US military equipment that was never delivered due to the revolution and the subsequent freezing of assets. The timing, however, undeniably created a perception of a quid pro quo. The White House at the time asserted that the agreements did not provide any new US money to Iran, as some posts suggested, but rather resolved a legitimate financial claim. This event highlighted the intricate dance between financial settlements and prisoner releases, setting a precedent for how such deals might be perceived and debated in the public sphere. It underscored the difficulty in separating the financial from the diplomatic in such sensitive international negotiations.The Joint Comprehensive Plan of Action (JCPOA) and its Financial Dimensions

Another significant period in US-Iran financial relations was the negotiation and implementation of the Joint Comprehensive Plan of Action (JCPOA) in 2015, often referred to as the Iran nuclear deal. This international agreement saw Iran agree to significantly cut back on its nuclear program in exchange for the lifting of various international sanctions. During the discussions surrounding the JCPOA, there was widespread misinformation, particularly the claim that the US gave $150 billion to Iran. This claim is inaccurate. The $150 billion figure often cited referred to the estimated amount of Iranian assets that were frozen globally due to sanctions, not money directly given by the United States. As part of the JCPOA, these assets, predominantly held in banks outside the US, became accessible to Iran. The US did not "give" this money; rather, it allowed other countries and international financial institutions to unfreeze funds that were already Iran's, but had been inaccessible under the sanctions regime. This distinction is crucial for understanding the nature of financial relief provided under such agreements. The lifting of sanctions allowed Iran to access its own funds, which were largely generated from oil revenues, facilitating its reintegration into the global financial system to a limited extent. This move was intended to provide Iran with economic incentives to adhere to the nuclear agreement, demonstrating how financial measures can be used as a carrot in international diplomacy.The Biden Administration's $6 Billion Deal: Unpacking the Details

In a more recent and highly scrutinized development, the Biden administration has cleared the way for the release of five American citizens detained in Iran. This complex agreement involved issuing a sanctions waiver for international banks to transfer approximately $6 billion (£4.8 billion) of frozen Iranian funds from South Korea to Qatar. This pivotal step paved the way for the release of the American detainees, who had been held in Iran for years. Concurrently, five Iranians held in the United States were also allowed to leave, highlighting the reciprocal nature of the deal. The core of the controversy surrounding this deal is the unfreezing of these Iranian assets. While critics have raised concerns about the money's potential misuse, the administration has strongly defended the arrangement, emphasizing the strict conditions placed on the funds. The narrative of "US releases money to Iran" in this context refers to facilitating access to funds that legally belong to Iran but were frozen due to sanctions.The Mechanics of the $6 Billion Transfer

The process of transferring these funds is not a direct cash handout. The $6 billion in question represents Iranian oil revenues that were held in South Korean banks due to US sanctions. To facilitate the transfer and ensure its controlled use, the Biden administration issued a blanket waiver, allowing these funds to be moved to restricted accounts in Qatar. This mechanism ensures that the money remains under scrutiny and is not directly deposited into the Iranian treasury without oversight. The move from South Korea to Qatar is a critical step in the process, establishing an intermediary where the funds can be monitored. The deputy treasury secretary told lawmakers that the US and Qatar have reached an agreement to prevent Iran from accessing the $6 billion recently unfrozen as part of the prisoner swap without strict oversight. This setup is designed to address concerns about the fungibility of money and to ensure adherence to the agreed-upon conditions for its use.Humanitarian Use: A Closer Look at the Stipulations

A central pillar of the Biden administration's defense of the $6 billion deal is the stipulation that the Iranian government now has access to these funds exclusively for humanitarian purposes. This includes purchasing food, medicine, and other essential goods that are not subject to sanctions. The argument is that this arrangement provides a humanitarian channel for Iran to address the needs of its population, while simultaneously securing the release of American citizens. However, critics of the White House’s decision to give Iran access to the $6 billion have voiced significant concerns, primarily revolving around the concept of fungibility. They argue that money is fungible, meaning that any funds Iran receives, regardless of whether they are explicitly earmarked for humanitarian purposes, can free up other resources for the Iranian government to spend on its military, proxy groups, or other non-humanitarian activities. This debate is at the heart of the controversy, with the administration asserting strict controls and critics remaining skeptical about the enforceability of those controls given the nature of financial flows. The administration maintains that every transaction will be monitored by Qatar and the US, ensuring compliance with the humanitarian-only stipulation.The Release of American Citizens: A Diplomatic Imperative

At the heart of the recent $6 billion deal is the imperative to secure the release of American citizens detained in Iran. For years, families of these detainees have campaigned tirelessly for their loved ones' freedom. The Biden administration’s decision to unfreeze these Iranian assets was directly linked to the successful negotiation for the return of five Americans who had been imprisoned in Iran. This diplomatic exchange underscores a consistent, albeit controversial, strategy employed by various US administrations: using financial or other concessions to bring Americans home. The Associated Press reported on the deal, highlighting that five Americans who had been held in Iran for years were on their way to the United States, in return for Iranians released from US custody and Tehran's access to the $6 billion in frozen oil revenues. While the immediate focus is on the human aspect of bringing citizens home, the broader implications of such deals are always subject to intense debate. For instance, critics often argue that such exchanges incentivize future hostage-taking, while proponents argue that a government's primary duty is to protect its citizens, even if it means engaging in difficult negotiations. It's a complex ethical and strategic dilemma that has faced US policymakers for decades.Criticisms and Controversies: The Fungibility Debate

The decision to facilitate the release of $6 billion in Iranian funds has ignited a firestorm of criticism, particularly from Republican lawmakers and those concerned about Iran's regional activities. The primary contention, as mentioned, centers on the concept of fungibility. Critics argue that even if the funds are nominally restricted to humanitarian purposes, having access to $6 billion allows Iran to reallocate other domestic funds that would have otherwise been spent on food and medicine. This, they contend, effectively frees up an equivalent amount of Iran's own resources for military spending, supporting proxy groups, or advancing its nuclear program. Republicans have particularly sought to link the $6 billion in unfrozen Iranian funds to the weekend attacks on Israeli civilians, though there is no direct evidence presented by the administration connecting these specific funds to those attacks. The administration has vehemently denied any such link, emphasizing the strict monitoring and the humanitarian nature of the funds. However, the political fallout highlights the deep mistrust and geopolitical sensitivities surrounding any financial transaction involving Iran. The debate over fungibility underscores a fundamental disagreement on how to manage the economic pressure on Iran while pursuing diplomatic objectives like prisoner releases.Sanctions and "Maximum Pressure": A Shifting Landscape

The recent financial dealings occur against a backdrop of evolving US sanctions policy towards Iran. Under the Trump administration, the US pursued a "maximum pressure" strategy, reimposing and intensifying sanctions after withdrawing from the JCPOA. This strategy aimed to cripple Iran's economy and force it to renegotiate a more comprehensive deal. Data from United Against Nuclear Iran, a group of former US officials, indicates that Iran's oil exports averaged 775,000 barrels per day under the Trump administration’s "maximum pressure" strategy. This figure is significantly lower than the levels seen before the sanctions. The Biden administration, while pursuing diplomatic avenues like the prisoner swap, has also continued to impose sanctions on Iran for its human rights abuses and destabilizing activities. For instance, President Biden announced more Iran sanctions on the anniversary of Mahsa Amini’s death, signaling a dual approach of both engagement and continued pressure. This demonstrates a nuanced foreign policy where specific financial agreements for humanitarian or prisoner exchange purposes can coexist with broader sanction regimes aimed at limiting Iran's revenue streams and curbing its problematic behaviors. The landscape of US-Iran financial relations is therefore not static but constantly shifting in response to geopolitical events and strategic objectives.The Broader Implications of Financial Diplomacy with Iran

The instances where the US releases money to Iran, whether through settlements or facilitating access to frozen assets, carry significant broader implications for international relations. These deals often serve as a barometer for the state of US-Iran relations, indicating periods of potential de-escalation or ongoing tension. They highlight the intricate balance between humanitarian concerns, national security interests, and the pursuit of diplomatic breakthroughs. On one hand, such financial diplomacy can be seen as a pragmatic tool to achieve specific, tangible outcomes, such as the release of unjustly detained citizens. It demonstrates a willingness to engage, even with adversaries, when vital interests are at stake. On the other hand, critics argue that these financial concessions could inadvertently empower a regime that is viewed as hostile, potentially undermining long-term strategic goals. The perception of these deals, both domestically and internationally, can also shape future negotiations and the willingness of other nations to engage in similar arrangements. The ongoing debate surrounding the fungibility of funds, for example, impacts how future financial agreements might be structured and monitored, emphasizing the need for robust oversight mechanisms.Navigating the Future: The Path Ahead for US-Iran Relations

The recent deal where the US releases money to Iran in exchange for prisoners marks another chapter in a long and tumultuous relationship. It underscores the continued complexity of dealing with a nation under heavy sanctions, where humanitarian needs, national security, and diplomatic leverage are constantly intertwined. The future path for US-Iran relations remains uncertain, heavily influenced by regional dynamics, Iran's nuclear ambitions, and its internal political landscape. Future engagements will likely continue to involve a mix of sanctions, diplomatic overtures, and, potentially, further financial negotiations. The lessons learned from past agreements, particularly concerning transparency and the fungibility of funds, will undoubtedly shape how any future deals are structured and presented to the public. As events unfold, the world will continue to watch how these financial threads weave into the broader tapestry of international diplomacy, hoping for stability while acknowledging the deep-seated challenges that persist. *** ## Conclusion The phrase "US releases money to Iran" encapsulates a complex reality far removed from a simple transfer of funds. As we have explored, these instances are typically rooted in the unfreezing of Iranian assets that were held for decades due to sanctions or legal disputes, often timed with critical diplomatic objectives like the release of American prisoners. From the 2016 settlement of a pre-revolution claim to the recent $6 billion deal for humanitarian purposes, each agreement is a testament to the intricate dance of international relations, where financial leverage meets humanitarian imperative. While the debates over fungibility and the broader implications of such deals will undoubtedly continue, understanding the historical context and the specific mechanics of these transactions is crucial for an informed perspective. It is not about "giving" money, but about facilitating access to funds that are legally Iran's, under strict conditions and often for the highest stakes: human lives. What are your thoughts on these complex financial and diplomatic exchanges? Do you believe such deals are a necessary evil for securing the release of citizens, or do they set a dangerous precedent? Share your perspectives in the comments below, and explore more articles on international relations and foreign policy on our site.

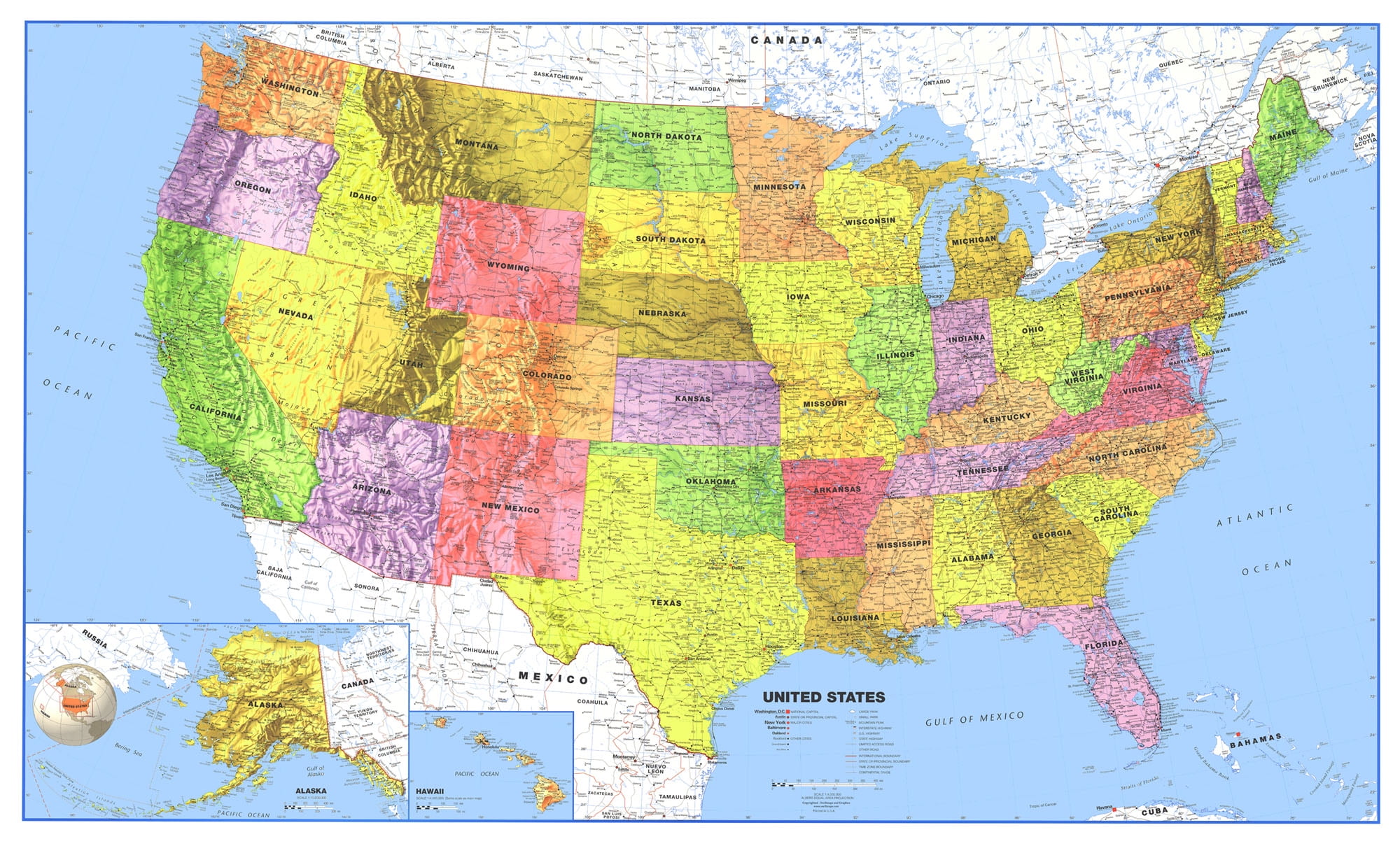

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo