Bank Melli Iran: Powering Digital Banking In The Heart Of Iran

When the term "BMI Iran" is mentioned, many might instinctively think of Body Mass Index and its implications for public health. However, in the context of Iran's financial landscape, "BMI" frequently refers to something entirely different, yet equally significant: Bank Melli Iran. This venerable institution, whose name translates to "National Bank of Iran," stands as a cornerstone of the nation's economy and a pioneering force in its digital transformation. Far from being a mere financial entity, Bank Melli Iran has evolved into a comprehensive digital powerhouse, aiming to redefine banking accessibility and security for millions.

As the first national and commercial retail bank of Iran, Bank Melli Iran holds a unique position in the country's history and economic development. Its journey reflects the broader narrative of Iran's financial sector, adapting to global challenges while simultaneously embracing technological advancements. With its robust digital platform, "Bam," the bank is not just facilitating transactions; it is shaping the future of financial services, making them smarter, safer, and more aligned with the dynamic needs of its diverse customer base.

Table of Contents

- Bank Melli Iran: A Pillar of National Finance

- Navigating the Digital Frontier: Bam, Bank Melli Iran's Smart Platform

- Enhanced Services and Features for Bam Users

- Regulatory Compliance and Global Vigilance

- The Global Footprint of Bank Melli Iran

- The "Government Single Window" Initiative

- The Evolution of Digital Banking at Bank Melli Iran

- Future Outlook and Strategic Importance

Bank Melli Iran: A Pillar of National Finance

Bank Melli Iran, often abbreviated as BMI, holds the distinguished title of being the first national and commercial retail bank in Iran. Established with the vision of fostering national economic growth and providing essential banking services, it has grown to become an indispensable component of the country's financial infrastructure. Its extensive network and deep-rooted presence across Iran underscore its foundational role in daily economic activities, from individual savings to large-scale industrial financing.

The sheer scale of Bank Melli Iran's operations is a testament to its significance. In 2016, it was recognized as the largest Iranian company in terms of annual income, reporting a staggering revenue of 364,657 billion rials. This figure not only highlights its immense financial capacity but also its pervasive influence across various sectors of the Iranian economy. As a wholly owned entity of the government of Iran, Bank Melli Iran operates with a mandate that extends beyond mere commercial banking; it is deeply intertwined with national economic policies and development objectives. This governmental backing provides it with a unique position of trust and stability within the domestic market, making it a preferred choice for a vast number of citizens and businesses alike. Its long-standing history and consistent performance have solidified its reputation as a reliable and robust financial partner, crucial for both national stability and individual prosperity. The bank's operations are a reflection of the nation's economic pulse, acting as both a barometer and a driver of financial activity.

Navigating the Digital Frontier: Bam, Bank Melli Iran's Smart Platform

In an era defined by rapid technological advancement, Bank Melli Iran has not merely kept pace but has actively shaped the digital banking landscape in the country. At the heart of this transformation lies "Bam," an innovative digital banking platform that represents a significant leap forward from traditional internet banking. The bank proudly states that "Bam is no longer just an internet bank; it's a comprehensive digital banking platform: smarter, safer, faster, and now more like you." This statement encapsulates the core philosophy behind Bam: to deliver a banking experience that is not only efficient but also deeply intuitive and personalized.

The development of Bam by Bank Melli Iran was a strategic move to address the evolving needs of modern customers who demand convenience, speed, and robust security in their financial interactions. The platform is meticulously designed to offer a seamless user experience, making complex banking tasks remarkably simple. "Samaneh Bam Bank Melli Iran, as it's known in Persian, is designed in such a way that you can enjoy its easy usability." This focus on user-friendliness ensures that a broad spectrum of customers, regardless of their technical proficiency, can navigate the platform with confidence and ease. From checking balances to transferring funds, every feature is crafted to be accessible and straightforward. Furthermore, Bam is engineered to meet the special needs of the customer, offering tailored services and functionalities that adapt to individual preferences and requirements. This customer-centric approach positions Bam not just as a tool for transactions but as a personalized financial assistant, empowering users with greater control and insight into their financial lives. Its commitment to being "smarter, safer, faster" is evident in every aspect of its design and operation, setting a new benchmark for digital banking services within Iran and showcasing Bank Melli Iran's dedication to innovation.

Enhanced Services and Features for Bam Users

The "Bam" digital banking platform by Bank Melli Iran is not just about a sleek interface; it's about delivering a rich suite of services designed to empower customers and simplify their financial management. A primary focus of Bam is to provide easy and secure access to essential banking functions, moving beyond the limitations of physical branches and traditional banking hours. For instance, customers who wish to utilize statement services are seamlessly integrated into the system: "Customers who wish to use statement services can become members of the Bam system." This direct access to financial records is a fundamental convenience for both individuals and businesses, enabling better financial tracking and planning.

Membership in the Bam system unlocks a range of special features that enhance the overall banking experience. A key benefit highlighted by Bank Melli Iran is the ability to "By becoming a member of this site, you can benefit from its special services, including receiving electronic statements." The transition to electronic statements not only offers environmental advantages but also provides users with instant access to their financial history, anytime and anywhere. This digital accessibility aligns with the broader goal of Bam to provide "smart banking services securely, simply, and quickly." The emphasis on speed and simplicity is crucial in today's fast-paced world, where customers expect immediate resolution to their banking needs. Furthermore, the platform ensures that all interactions are conducted with the highest level of security, protecting sensitive financial data from unauthorized access. For existing users, the process is streamlined: "Login for registered users, specifically for members of Bank Melli's internet services," ensuring a dedicated and secure portal for established clientele. Ultimately, Bam, as the digital banking system of Bank Melli Iran, is meticulously designed to provide "smart and secure banking services," making it an indispensable tool for modern financial management in Iran.

Regulatory Compliance and Global Vigilance

Operating as a national bank with international reach, Bank Melli Iran faces a complex web of regulatory requirements and global scrutiny. The bank is committed to adhering to stringent "Compliance regulations, anti-money laundering, and combating the financing of terrorism." These measures are critical for any financial institution operating in the modern global economy, aiming to prevent illicit financial activities and ensure the integrity of the banking system. The implementation of such robust internal controls is essential for maintaining trust and stability within the financial sector, both domestically and internationally.

However, Bank Melli Iran, like many Iranian entities, operates under specific international considerations. The provided data highlights concerns articulated in "Security Council Resolution 1803 of March 3, 2008, as a bank domiciled in Iran, with respect to which (and its branches and subsidiaries abroad) financial institutions should exercise vigilance due to concerns that it provides financial support for entities engaged in Iran’s nuclear and missile programs." This resolution underscores the heightened level of scrutiny and vigilance that international financial institutions are advised to exercise when dealing with Bank Melli Iran and its global branches and subsidiaries. Such concerns, while not necessarily confirmed by the bank itself, necessitate a rigorous approach to compliance and transparency in all its operations. The bank's commitment to anti-money laundering (AML) and combating the financing of terrorism (CFT) is thus not just a matter of best practice but a crucial aspect of navigating the intricate landscape of international sanctions and financial regulations. This environment demands continuous adaptation and adherence to evolving global standards, ensuring that Bank Melli Iran maintains its operational capabilities while addressing international concerns.

The Global Footprint of Bank Melli Iran

Despite the complex international financial landscape, Bank Melli Iran has historically maintained a significant global presence, reflecting its role as a key player in facilitating international trade and financial transactions for Iran. The bank's network of international branches and representative offices underscores its ambition to serve the financial needs of Iranian expatriates, businesses engaged in international trade, and foreign entities seeking to conduct legitimate business with Iran. While the operational status and scope of services at these locations may vary due to evolving geopolitical and regulatory circumstances, their existence signifies Bank Melli Iran's enduring commitment to global connectivity.

The provided data references several key international locations, illustrating the breadth of Bank Melli Iran's reach:

- PO Box 1420, 10153 New York: While direct banking operations in the U.S. have faced significant restrictions, the mention of a New York address points to a historical or representative presence aimed at maintaining a connection with the global financial hub.

- PO Box 248, Hamad Bin Abdulla St, Fujairah (UAE): The United Arab Emirates has historically been a crucial gateway for trade with Iran, and the presence of "Bank Melli Iran in UAE" in cities like Fujairah and Sharjah ("PO Box 459, Al Borj St, Sharjah") highlights its strategic importance in facilitating regional commerce.

- 43 Avenue Montaigne, 75008 Paris: A presence in Paris signifies the bank's historical ties to European financial markets and its role in supporting Euro-Iranian trade relations.

- Bank Melli Iran Bldg, 111 St 24, 929 Arasat Baghdad Iraq: Iraq, as a neighboring country and significant trade partner, naturally hosts a strong Bank Melli Iran presence, facilitating cross-border economic activities.

- PO Box 2643, Ruwi, 112 Muscat Oman: Oman has emerged as an increasingly important regional partner for Iran, and the bank's office in Muscat underscores its role in fostering financial ties in the Gulf region.

- PO Box 2656, Liva Street: This likely refers to another office in the region, further emphasizing the bank's widespread network.

These international outposts are not merely addresses; they represent the bank's strategic efforts to maintain channels for legitimate financial interactions, provide services to Iranian citizens abroad, and support the country's economic objectives despite the challenges posed by international sanctions. The ability of Bank Melli Iran to sustain this global footprint, even in a constrained environment, speaks to its resilience and its central role in Iran's engagement with the world economy.

The "Government Single Window" Initiative

Beyond its core retail and commercial banking functions, Bank Melli Iran plays a pivotal role in the broader national digital transformation agenda, particularly through its involvement in the "Government Single Window" initiative. The repeated mention of "Government Single Window Bank Melli Iran" in the provided data highlights a significant strategic direction for the bank: to act as a central conduit for citizens and businesses to access various government services. This initiative is a crucial step towards streamlining bureaucratic processes, enhancing transparency, and improving the overall efficiency of public service delivery in Iran.

The concept of a "single window" is designed to consolidate multiple government services into one accessible platform, reducing the need for citizens to visit various offices or navigate complex administrative procedures. By positioning Bank Melli Iran as a key facilitator of this system, the government leverages the bank's extensive network, its robust digital infrastructure (like the Bam platform), and its inherent trust among the populace. This means that, in the future, citizens might be able to pay taxes, apply for permits, access social security benefits, or complete other governmental transactions directly through the bank's digital channels or physical branches. This integration offers immense benefits: it saves time for citizens, reduces administrative burdens for government agencies, and combats corruption by centralizing and digitizing interactions. For Bank Melli Iran, participating in the Government Single Window initiative further solidifies its status as a vital national institution, extending its utility beyond traditional banking to become an integral part of the nation's governance and public service framework. It underscores the bank's commitment to serving the wider public good and contributing to the modernization of Iran's administrative landscape.

The Evolution of Digital Banking at Bank Melli Iran

The journey of Bank Melli Iran into the digital realm is a story of continuous adaptation and innovation, driven by the imperative to remain relevant and efficient in a rapidly changing world. The development and continuous enhancement of the "Bam" platform exemplify this commitment, transforming the bank from a traditional brick-and-mortar institution into a leading digital service provider.

From Traditional to Transformative

For decades, Bank Melli Iran served its customers primarily through its vast network of physical branches. While these branches remain important, the advent of digital technologies presented both a challenge and an opportunity. The bank recognized that to serve a tech-savvy population and to overcome geographical limitations, a robust digital presence was essential. The transition to a "comprehensive digital banking platform" signifies a shift from merely offering online access to services to fundamentally reimagining the banking experience. This transformation involves not just digitizing existing processes but introducing entirely new functionalities that were previously impossible, such as real-time notifications, personalized financial insights, and seamless integration with other digital services. This strategic pivot ensures that Bank Melli Iran remains at the forefront of financial innovation in Iran, catering to the evolving demands of its diverse clientele.

Security and Trust in the Digital Age

In the digital landscape, security is paramount, especially for financial transactions. Bank Melli Iran places a strong emphasis on ensuring that its digital services are "smarter, safer, faster." The term "safer" is not just a marketing slogan; it reflects the bank's investment in advanced security protocols, encryption technologies, and fraud prevention measures. For a financial institution, maintaining customer trust is non-negotiable, and in the digital sphere, this trust is built on the assurance that personal and financial data are protected from cyber threats. The bank's commitment to providing "secure" services is a cornerstone of its digital strategy, ensuring that customers can conduct their banking activities with peace of mind. This focus on security is crucial for the widespread adoption of digital banking, as users must feel confident that their assets and information are safeguarded against potential risks.

User-Centric Design Philosophy

A distinguishing feature of Bam is its user-centric design philosophy. The statement "now more like you" indicates a deliberate effort to create a personalized and intuitive banking experience. This means the platform is designed not just for functionality but for ease of use and adaptability to individual preferences. The emphasis on "easy usability" ensures that the platform is accessible to a wide range of users, from digital natives to those less familiar with technology. By focusing on the customer's needs and feedback, Bank Melli Iran aims to make digital banking an enjoyable and efficient part of daily life. This approach includes simplifying complex processes, providing clear navigation, and offering responsive customer support within the digital ecosystem. This dedication to user experience is vital for encouraging widespread adoption and ensuring that the digital transformation truly benefits all customers of Bank Melli Iran.

Future Outlook and Strategic Importance

Bank Melli Iran, as a pivotal financial institution, faces a future shaped by both domestic economic imperatives and complex international dynamics. Its strategic importance to Iran's economy cannot be overstated, and its ability to adapt to evolving circumstances will define its trajectory.

Adapting to Sanctions and Global Finance

One of the most significant challenges for Bank Melli Iran is navigating the intricate web of international sanctions and the vigilance advised by global bodies, as highlighted by Security Council Resolution 1803. This environment necessitates constant adaptation, innovative financial solutions, and strict adherence to compliance standards to facilitate legitimate international transactions. Despite these hurdles, the bank continues to seek avenues for international engagement, supporting Iran's trade and economic ties with various countries. Its resilience in maintaining a global footprint, even if curtailed, underscores its determination to remain connected to the international financial system. The future will likely see Bank Melli Iran continuing to refine its strategies to mitigate the impact of sanctions while upholding its commitment to transparency and compliance in its operations.

The Role of Bank Melli Iran in Iran's Economy

Bank Melli Iran remains an indispensable pillar of Iran's economy. As a wholly government-owned entity and the largest Iranian company by revenue in 2016, its financial health and operational stability directly impact the nation's economic well-being. The bank plays a crucial role in providing financial services to a vast population, supporting small and medium-sized enterprises, and facilitating large-scale national projects. Its digital transformation through the "Bam" platform is not just about customer convenience; it's a strategic investment in the efficiency and modernization of the entire Iranian financial sector. By leading the charge in digital banking and participating in initiatives like the "Government Single Window," Bank Melli Iran is actively contributing to economic growth, financial inclusion, and the overall digital transformation of the country. Its future will undoubtedly involve deepening its digital capabilities, expanding its service offerings, and continuing to serve as a vital engine for Iran's economic development, adapting to both internal needs and external pressures.

Conclusion

In understanding "BMI Iran," it becomes clear that while the acronym might first evoke thoughts of health metrics, its profound significance within Iran's financial landscape points directly to Bank Melli Iran. This institution is far more than just a bank; it is a foundational pillar of the national economy, a pioneering force in digital banking through its "Bam" platform, and a crucial player in facilitating both domestic and international financial activities. From its historical role as the first national bank to its current status as a leader in digital transformation, Bank Melli Iran has consistently adapted to serve the evolving needs of its customers and the nation.

The "Bam" platform exemplifies Bank Melli Iran's commitment to providing smart, secure, and user-friendly digital services, making banking more accessible and efficient for millions. Despite facing complex international regulatory environments and challenges, the bank maintains a strategic global presence and continues to innovate, as evidenced by its involvement in initiatives like the "Government Single Window." Bank Melli Iran's journey is a testament to its resilience and its enduring importance in shaping Iran's financial future. We encourage you to explore the advancements in digital banking and consider how such institutions are navigating the complexities of the modern global economy. What are your thoughts on the role of national banks in driving digital transformation, especially in challenging environments? Share your insights in the comments below.

- Iran Mexican Mixed

- Did Isreal Attack Iran

- Evin Prison Tehran Iran

- Iran Sex Movie

- Iran Soccer Team Schedule

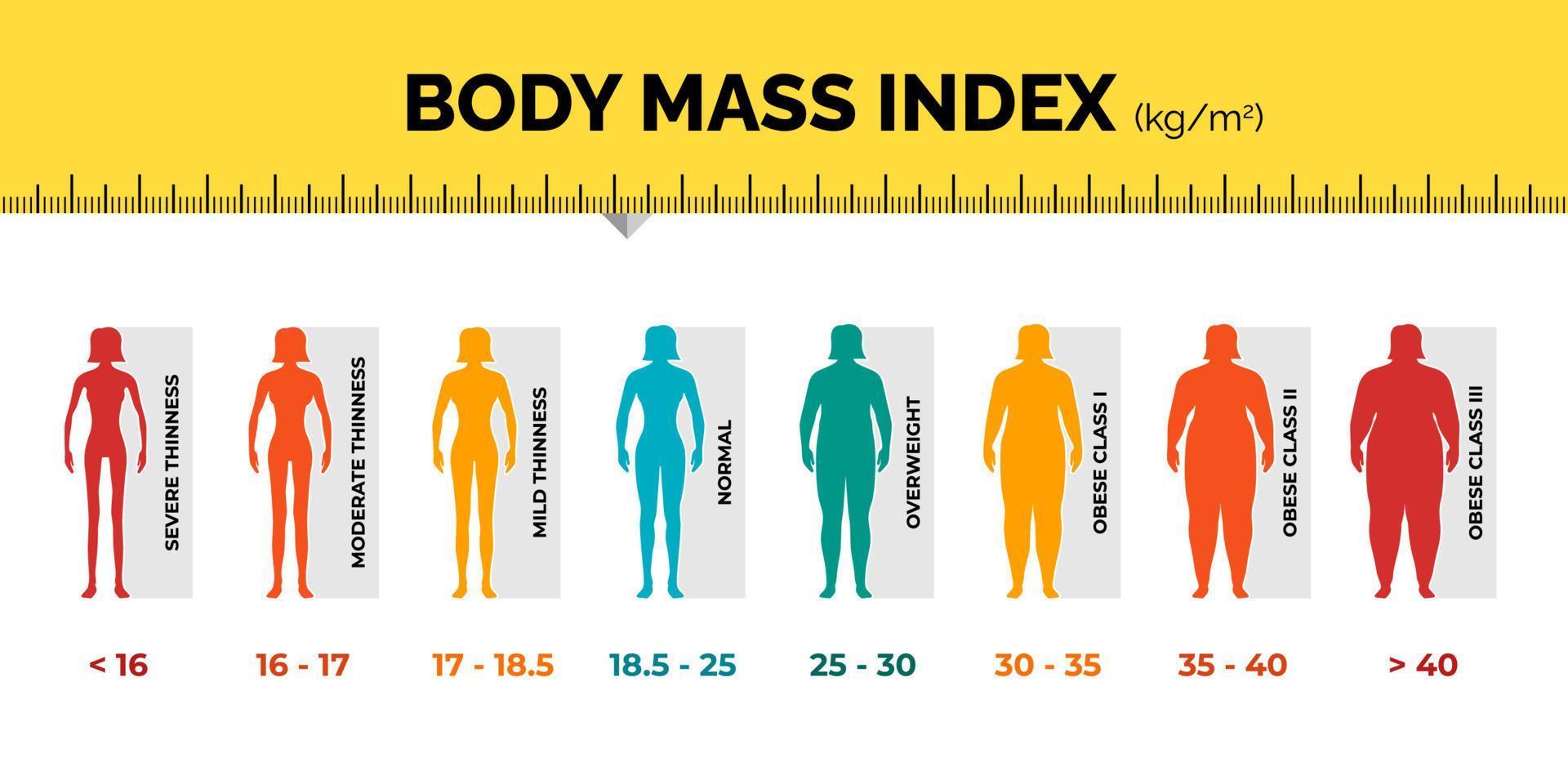

Is BMI An Accurate Way To Measure Body Fat? Here’s What Science Says…

Body-Mass-Index (BMI) - Vitaes - Das Gesundheit Magazin

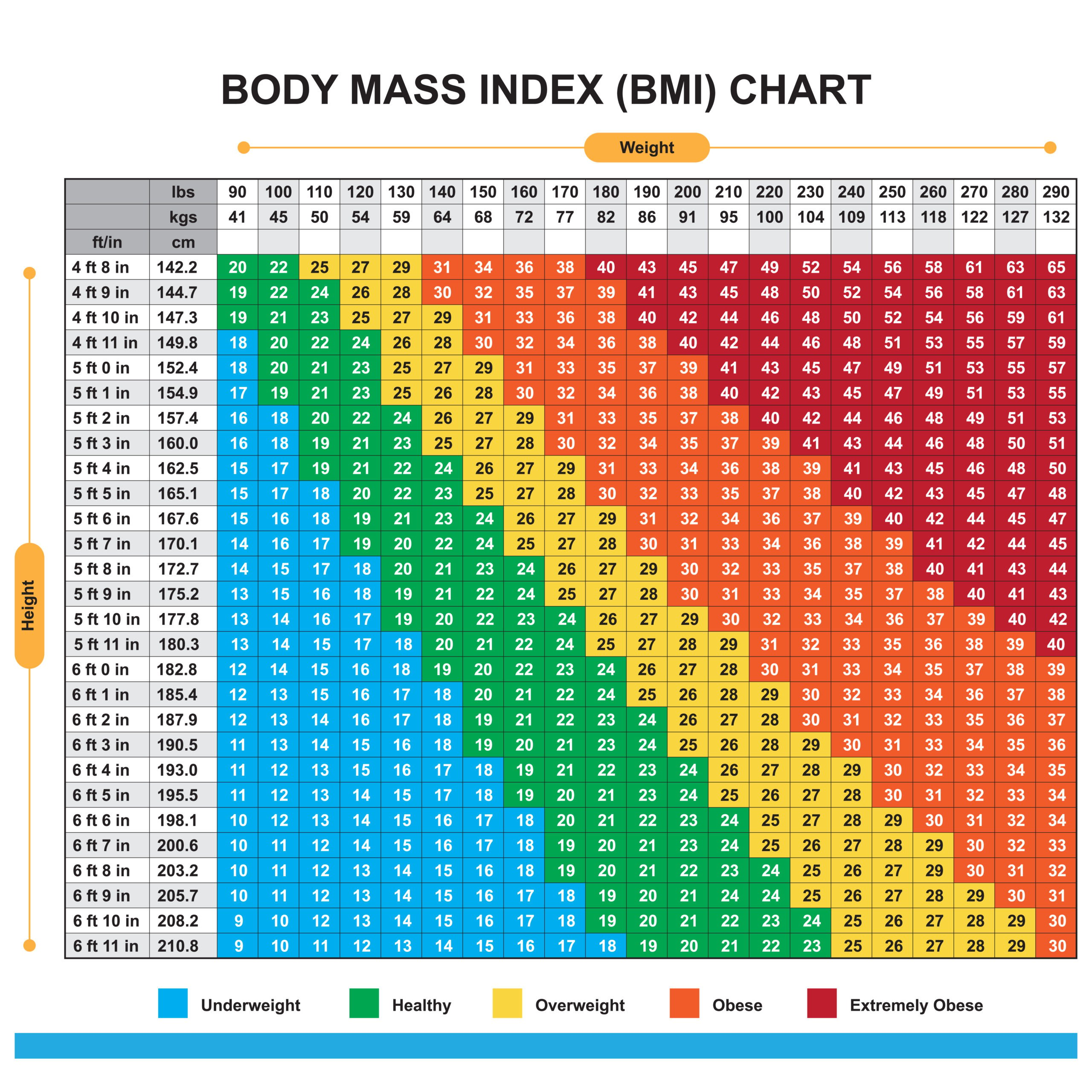

BMI classification chart measurement woman colorful infographic with