Iran's Oil Riches: Unveiling Its Vast Hydrocarbon Wealth

Iran, a nation steeped in history and rich in natural resources, stands as a pivotal player in the global energy landscape. Its subterranean wealth, particularly its vast oil and gas reserves, has long been a subject of international interest, shaping geopolitical dynamics and economic trajectories. Understanding "how much oil is in Iran" is not merely an academic exercise; it's crucial for comprehending global energy security, market stability, and the nation's own economic resilience.

From the sprawling deserts to the depths of its continental shelf, Iran possesses an extraordinary endowment of hydrocarbons. This article delves deep into the specifics of Iran's oil reserves, its production capabilities, export patterns, and consumption habits, drawing on the latest data and expert analyses to paint a comprehensive picture of its significant role in the world's energy equation. We will explore the sheer scale of its proven reserves, the intricate network of its oil and gas fields, and the fluctuating dynamics of its output and exports, often influenced by complex geopolitical factors.

Table of Contents

- Iran's Proven Oil Reserves: A Global Powerhouse

- Unearthing the Depths: Iran's Hydrocarbon Discoveries

- Iran's Oil Production: A Fluctuating Tapestry

- Navigating the Global Market: Iran's Oil Exports

- Domestic Consumption Patterns in Iran

- The Impact of Sanctions on Iran's Oil Industry

- The Strategic Significance of Iran's Oil

- Future Outlook and Challenges

Iran's Proven Oil Reserves: A Global Powerhouse

When we ask "how much oil is in Iran," the most striking answer lies in its colossal proven oil reserves. As of 2016, Iran holds an astonishing 157,530,000,000 barrels of proven oil reserves. This monumental figure positions Iran as the #4 ranked country globally in terms of oil reserves, a testament to its immense natural endowment. To put this into perspective, Iran's reserves account for approximately 9.54% of the world’s total oil reserves, which stand at an estimated 1,650,585,140,000 barrels. Beyond its global standing, Iran's reserves also represent a significant portion of the Middle East's hydrocarbon wealth. With about 157 billion barrels of proven crude oil, Iran holds approximately a quarter (24 percent) of the Middle East’s proven oil. This regional dominance underscores its strategic importance within a region that is the heartland of global oil supply. These reserves are not merely static figures; they represent the foundation of Iran's economic power and its long-term energy security. The concept of "proven reserves" implies that these quantities are recoverable under existing economic and operating conditions, using current technology, making them a reliable indicator of a nation's long-term oil potential. Furthermore, Iran's proven reserves are equivalent to 239.2 times its annual consumption levels, indicating a remarkable longevity for its domestic supply based on current usage rates. This substantial reserve base provides Iran with considerable leverage in the global energy market, even amidst various external pressures.Unearthing the Depths: Iran's Hydrocarbon Discoveries

Iran's journey as a major oil producer began over a century ago, and since then, exploration efforts have continuously expanded its known hydrocarbon wealth. The sheer scale of discoveries highlights the country's vast geological potential. Based on the latest oil and gas reports, Iran has successfully discovered 145 hydrocarbon fields and 297 oil and gas reservoirs. This extensive network of discoveries is a testament to persistent exploration and development efforts across the country. ### The Anatomy of Iran's Oil and Gas Fields The composition of these discoveries reveals a significant emphasis on oil. A total of 102 fields are primarily oil-producing, while the remaining 43 are gas fields. This balance underscores Iran's dual role as a major player in both the global oil and natural gas markets. The existence of 205 oil reservoirs and 92 natural gas reservoirs further illustrates the rich diversity of its underground resources. Each reservoir represents a unique geological formation capable of holding significant volumes of hydrocarbons, contributing to the overall "how much oil is in Iran" equation. ### Multi-Pay Zones and Reservoir Diversity A particularly important characteristic of many of Iran's fields is the presence of multiple pay zones. This means that a single oil or gas field can contain several distinct layers of hydrocarbon-bearing rock, each capable of producing oil or gas. This geological complexity enhances the total recoverable reserves and extends the productive life of the fields. The diversity of these reservoirs, ranging from mature giants to newly discovered formations, ensures a continuous pipeline for future extraction and contributes significantly to the country's long-term energy outlook. The ongoing discovery of new fields and reservoirs, as well as the re-evaluation of existing ones with advanced technologies, continues to refine our understanding of the true extent of Iran's hydrocarbon potential.Iran's Oil Production: A Fluctuating Tapestry

While proven reserves indicate potential, actual production figures reflect a nation's ability to extract and bring oil to market. Iran's crude oil production has seen significant fluctuations over the decades, influenced by a myriad of factors including geopolitical events, technological advancements, and international sanctions. Understanding these dynamics is key to grasping "how much oil is in Iran" is actually being brought to the surface. ### Historical Peaks and Troughs Iran's oil production reached an all-time high of 6,677,000 barrels per day (bbl/d) in November of 1976. This period represented a peak in its oil output, cementing its position as a global energy giant. However, this high was followed by a dramatic decline, reaching a record low of 510,000 bbl/d in October of 1980, a period marked by the Iranian Revolution and the subsequent Iran-Iraq War. This historical context highlights the vulnerability of oil production to political instability and conflict. Overall, crude oil production in Iran averaged 3,442.64 bbl/d/1k (thousand barrels per day) from 1973 until 2025, demonstrating a long-term average that has seen significant swings. ### Recent Production Trends In recent years, Iran's oil production has shown signs of recovery and fluctuation. According to the International Energy Agency’s (IEA) latest oil market report, released in October, Iran produced 3.14 million barrels of crude oil per day, excluding condensates. More granular data from Kpler trade intelligence firm’s tanker tracking indicates that Iran’s crude oil and gas condensate exports reached 1.812 million barrels per day (mb/d) together in October, the highest since 2019 and about 370,000 b/d more than in September 2023. Looking at more recent production data: * Production was reported at 3,280,000 barrel/day in January 2025. * This records a slight decrease from the previous number of 3,293,000 barrel/day for December 2024. * Crude oil production in Iran decreased to 3303 bbl/d/1k in May from 3328 bbl/d/1k in April of 2025. * Monthly production data, averaging 3,521,000 barrel/day from January 2002 to January 2025, showcases the long-term trend. * More recent data indicates Iran crude oil production is at a current level of 4.22 million barrels per day (m), up from 4.208m last month and up from 4.028m one year ago. This represents a change of 0.29% from last month and 4.77% from one year ago, signaling a notable increase in output. These figures illustrate a dynamic production environment, where Iran is actively working to maximize its output, often in the face of external constraints. The ability to increase production, even incrementally, directly impacts the answer to "how much oil is in Iran" that is available for global markets.Navigating the Global Market: Iran's Oil Exports

Iran's oil exports are a critical component of its economy, serving as the primary source of foreign currency reserves. However, these exports have been heavily impacted by international sanctions, leading to significant fluctuations in volume and destination. The flow of "how much oil is in Iran" that reaches the international market is a complex interplay of supply, demand, and geopolitical pressures. ### Export Volumes and Growth Despite the challenges, Iran has demonstrated a remarkable ability to sustain and even increase its oil exports at various times. * In 2024, Iran exported 587 million barrels of oil, an impressive increase of 10.75 percent compared to 2023’s 530 million barrels. This growth underscores Iran's efforts to circumvent sanctions and find markets for its crude. * During the first quarter of 2024, Iran exported 141.7 million barrels of oil, marking a substantial 28 percent increase over the same period last year. This surge in exports directly enhances Tehran’s currency reserves, providing vital economic support. * Over the four years since the start of the Biden administration, with less than one month remaining in its term, Iran has exported a cumulative total of nearly 1.98 billion barrels of oil. This cumulative figure highlights the persistent nature of Iran's oil trade, even under stringent sanctions. ### Key Importers and Trade Dynamics China stands out as the world's largest crude importer and Iran's top customer. According to shiptracking data, China bought an average of 1.05 million barrels per day (bpd) of Iranian oil in the first 10 months of 2023. This consistent demand from China has been a lifeline for Iran's oil industry, allowing it to maintain significant export volumes despite widespread sanctions. While the United States generally does not import oil from Iran due to sanctions, the United Nations Comtrade database on international trade reported US imports from Iran at US$6.29 million during 2024. This figure, while small in the context of oil, likely represents non-oil goods or specific exceptions. The resilience of Iran's export network, particularly its ability to find buyers in Asian markets, is a key factor in how much oil from Iran makes its way to global consumers.Domestic Consumption Patterns in Iran

While Iran is a major oil producer and exporter, it also has significant domestic energy needs. Understanding its consumption patterns provides a complete picture of its oil balance sheet. Iran ranks #12 in the world for oil consumption, indicating a substantial internal demand for petroleum products. This accounts for about 1.86% of the world’s total consumption of 97,103,871 barrels per day. On a per capita basis, Iran's consumption is also notable. Based on the 2016 population of 83,812,228 people, Iran consumes approximately 0.9 gallons of oil per capita every day. This translates to an annual consumption of 330 gallons per capita, or roughly 8 barrels per person per year. These figures highlight the energy intensity of the Iranian economy and the daily reliance of its population on oil for transportation, heating, and industrial activities. The balance between production, exports, and domestic consumption is crucial for Iran's energy policy and its overall economic stability. The more oil consumed domestically, the less is available for export, directly impacting the revenue generated from "how much oil is in Iran" that is sold internationally.The Impact of Sanctions on Iran's Oil Industry

The question of "how much oil is in Iran" that can actually be sold on the international market is inextricably linked to the severe international sanctions imposed on Tehran's oil exports. These sanctions have been a defining feature of Iran's oil industry for several years, significantly impacting its production capacity, export volumes, and revenue generation. The most stringent of these measures were reimposed sanctions on Tehran’s oil exports in late 2018, a few months after President Trump withdrew from the Iran nuclear deal during his first term. These "maximum pressure" sanctions aimed to cut off Iran's oil revenues, thereby limiting its ability to fund various activities. The immediate effect was a sharp decline in Iran's crude oil exports, forcing many traditional buyers to seek alternative sources. Despite these severe restrictions, Iran has shown considerable ingenuity and resilience in maintaining a significant level of oil exports, primarily through covert operations, ship-to-ship transfers, and offering discounts to buyers willing to risk secondary sanctions. The data on increased exports in 2024 and the cumulative exports under the Biden administration clearly indicate that while sanctions have undeniably hurt Iran's oil industry, they have not completely halted its ability to export. The continued demand from key customers like China, as noted earlier, plays a crucial role in enabling Iran to navigate the sanctions regime. The interplay between Iran's vast reserves and the external pressures of sanctions remains a critical factor in determining its actual contribution to global oil supply.The Strategic Significance of Iran's Oil

The vast quantities of "how much oil is in Iran" hold profound strategic significance, not just for the nation itself but for the entire global energy landscape. Iran's position as a holder of some of the world’s largest deposits of proved oil, as confirmed by the Iran Energy Balance Sheet, makes it an indispensable, albeit sometimes volatile, component of global energy security. Its substantial proven reserves provide Iran with long-term leverage in international relations. The sheer volume of oil means that Iran will remain a significant producer for decades to come, influencing supply dynamics and pricing. Any disruption to Iran's production or export capabilities, whether due to internal factors or external pressures like sanctions, has the potential to send ripples through the global oil market, affecting prices and supply stability for consumers worldwide. Furthermore, Iran's oil wealth underpins its domestic economy, funding government programs, infrastructure development, and various social services. The ability to monetize its oil reserves directly impacts its national budget and its capacity to withstand economic shocks. The ongoing efforts to increase production and exports, as evidenced by recent data, highlight the critical role oil plays in Iran's economic survival and strategic autonomy. The sheer scale of its oil industry, with its extensive network of fields and reservoirs, means that Iran's energy policies and capabilities are always under the global spotlight.Future Outlook and Challenges

The future of "how much oil is in Iran" that can be produced and exported is subject to a complex array of factors. While the nation boasts immense proven reserves and a robust infrastructure for extraction, several challenges and opportunities lie ahead. On the one hand, Iran's vast hydrocarbon fields, with their multiple pay zones and extensive discovered reservoirs, promise long-term production potential. Should international relations normalize and sanctions be eased or lifted, Iran has the capacity to significantly ramp up its production and exports, potentially bringing millions of additional barrels per day to the global market. This would not only boost Iran's economy but could also help stabilize global oil prices. The recent increases in production and exports, even under sanctions, demonstrate an underlying capability that could be unleashed given more favorable conditions. However, significant challenges persist. The current sanctions regime continues to hamper foreign investment, limit access to advanced technologies for extraction and refining, and complicate international trade. This can lead to underinvestment in its oil infrastructure, potentially impacting long-term production efficiency and recovery rates. Geopolitical tensions in the Middle East also pose a constant threat to oil production and export routes. Moreover, the global energy transition towards cleaner sources of energy presents a long-term challenge for all oil-dependent economies, including Iran. While oil will remain crucial for decades, the increasing focus on renewable energy and electric vehicles could eventually temper demand growth. Iran will need to diversify its economy and potentially invest in renewable energy technologies to ensure sustainable growth beyond its oil wealth. In conclusion, Iran's oil reserves are undeniably massive, cementing its status as a top-tier global energy power. The question of "how much oil is in Iran" is not just about the reserves themselves, but also about the complex interplay of production capabilities, export strategies, domestic consumption, and the pervasive impact of international sanctions. As the world navigates its energy future, Iran's role, shaped by its vast hydrocarbon wealth and its evolving geopolitical landscape, will undoubtedly remain central to the global energy conversation.We hope this comprehensive analysis has shed light on the intricate details of Iran's oil wealth. What are your thoughts on Iran's role in the global energy market? Share your perspectives in the comments below, or explore our other articles on global energy dynamics to deepen your understanding!

Iran Supply Cut Not a Problem, There's Enough Oil: IEA

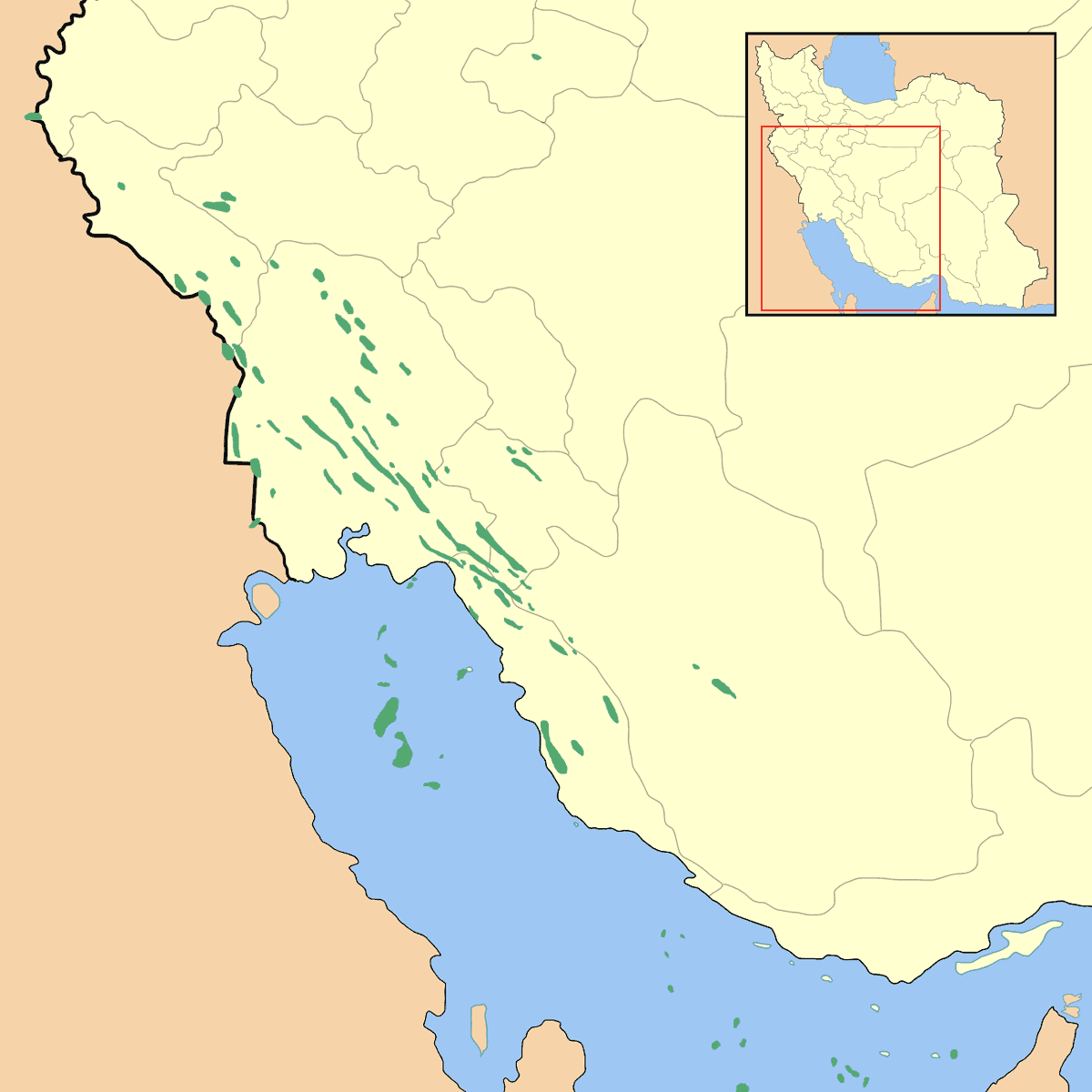

Iran Oil Map - MapSof.net

How Much Oil Does Iran Produce? - Oil Markets Daily (NYSEARCA:USO